How To Fill Out A Personal Financial Statement

What is how to fill out a personal financial statement?

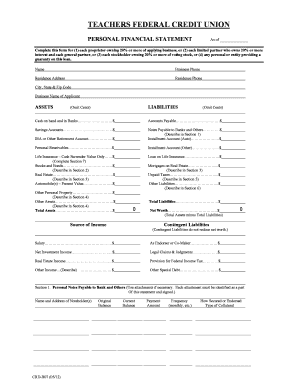

When it comes to managing your finances effectively, filling out a personal financial statement is an essential step. It is a document that helps you assess your financial health by showcasing your assets, liabilities, income, and expenses. By accurately filling out this statement, you gain valuable insights into your financial situation and can make informed decisions. If you're unsure about how to fill out a personal financial statement, don't worry. This guide will walk you through the process step-by-step, making it easy and straightforward for you.

What are the types of how to fill out a personal financial statement?

There are different types of personal financial statements to choose from based on your needs. Here are some common types: 1. Personal Balance Sheet: This type provides a snapshot of your financial position by listing your assets and liabilities. 2. Cash Flow Statement: It focuses on your income and expenses over a specific period, highlighting your cash flow. 3. Income Statement: Also known as a profit and loss statement, it shows your income and expenses to determine your net profit or loss. 4. Statement of Changes in Net Worth: This type tracks changes in your net worth over time, reflecting factors such as investments and debt. Choose the type that aligns with your financial goals and provides the most comprehensive view of your finances.

How to complete how to fill out a personal financial statement

Now that you understand the importance and types of personal financial statements, here's a step-by-step guide to help you complete one: 1. Gather your financial documents: Collect all relevant documents such as bank statements, investment statements, loan statements, and credit card statements. 2. Create a list of assets: Include all your assets, such as cash, savings, investments, real estate, and vehicles. Assign values to each asset. 3. Determine your liabilities: List all your debts and obligations, such as mortgages, loans, credit card balances, and outstanding bills. 4. Calculate your net worth: Subtract your total liabilities from your total assets to determine your net worth. 5. Analyze income and expenses: Record your monthly income from various sources and categorize your expenses, such as housing, transportation, utilities, and entertainment. 6. Evaluate your financial health: Analyze the information in your personal financial statement to assess your financial health, identify areas for improvement, and set financial goals. By following these steps, you can efficiently complete a personal financial statement and gain valuable insights into your financial situation.

Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. With pdfFiller as your go-to PDF editor, you can easily get your documents done while enjoying a seamless and efficient experience. Start filling out your personal financial statement today and take control of your financial future!