What is fillable personal financial statement?

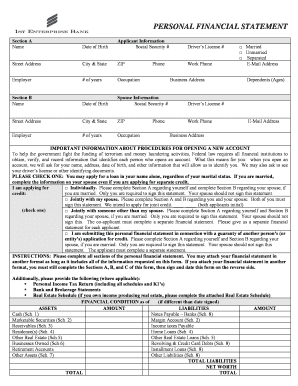

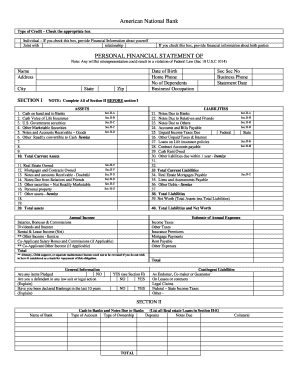

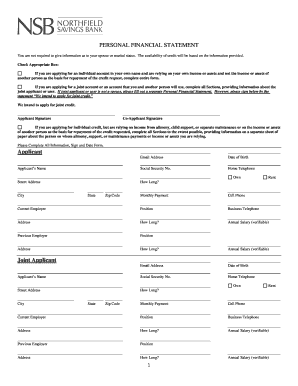

A fillable personal financial statement is a document that allows individuals to provide detailed information about their financial status. It includes information about their assets, liabilities, income, and expenses. This statement is used by individuals for various purposes, such as applying for loans, managing personal finances, or assessing their financial health.

What are the types of fillable personal financial statement?

There are several types of fillable personal financial statements available. These include:

Personal Balance Sheet: This statement provides an overview of an individual's assets, liabilities, and net worth.

Income Statement: This statement focuses on an individual's income and expenses, helping them analyze their financial performance.

Cash Flow Statement: This statement tracks the inflow and outflow of cash, giving individuals insights into their cash management.

Budget Statement: This statement helps individuals plan and track their monthly or annual budget, ensuring they stay within their financial means.

How to complete fillable personal financial statement

Completing a fillable personal financial statement is easy and straightforward. Here are the steps to follow:

01

Gather all relevant financial documents, including bank statements, investment statements, and loan statements.

02

Enter your personal information, such as name, contact details, and social security number.

03

Provide details about your assets, including properties, vehicles, savings accounts, investments, and any other valuable possessions.

04

List your liabilities, such as mortgages, loans, credit card debts, and any other outstanding debts.

05

Include information about your income, including salary, bonuses, rental income, and any other sources of income.

06

Note down your monthly expenses, including housing costs, transportation expenses, utility bills, groceries, and other regular expenses.

07

Calculate your net worth by subtracting your liabilities from your assets.

08

Review the completed statement for accuracy and make any necessary adjustments.

09

Save and store the fillable personal financial statement for future reference.

With pdfFiller, completing fillable personal financial statements has never been easier. Take advantage of their user-friendly platform to create, edit, and share your documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is your go-to PDF editor to efficiently manage your financial statements and get your documents done with ease.