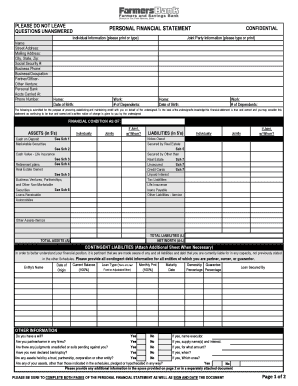

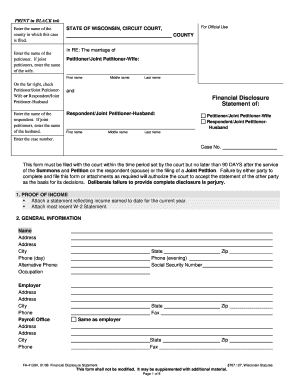

Personal Financial Statement Definition

What is personal financial statement definition?

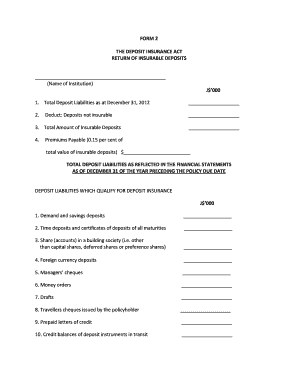

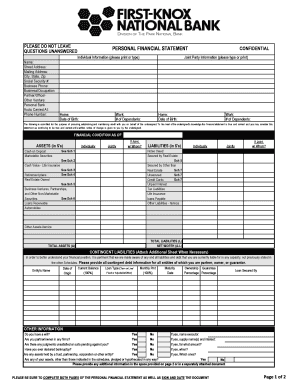

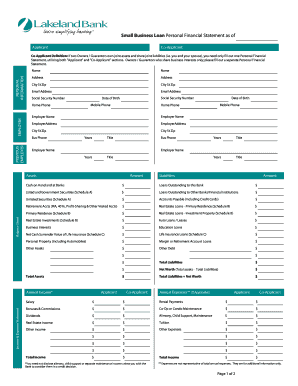

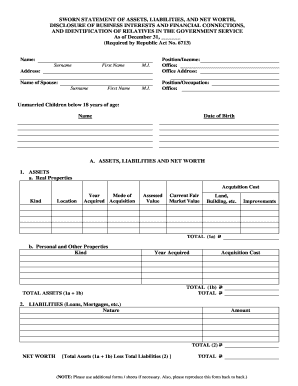

A personal financial statement is a document that provides an overview of an individual's financial situation. It includes information about their assets, liabilities, income, and expenses. This statement helps individuals and financial institutions assess an individual's financial health and make informed decisions.

What are the types of personal financial statement definition?

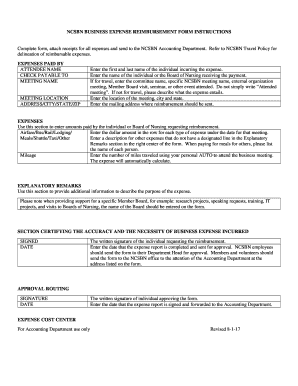

There are several types of personal financial statements, each serving a specific purpose. The common types include:

How to complete personal financial statement definition

Completing a personal financial statement can seem overwhelming, but with these steps, it becomes more manageable:

pdfFiller is an excellent tool for creating, editing, and sharing personal financial statements online. With its unlimited fillable templates and powerful editing tools, pdfFiller empowers users to efficiently complete their financial statements. Whether you're an individual or a financial professional, pdfFiller is the go-to PDF editor for getting your documents done.