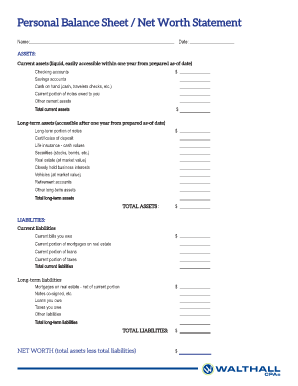

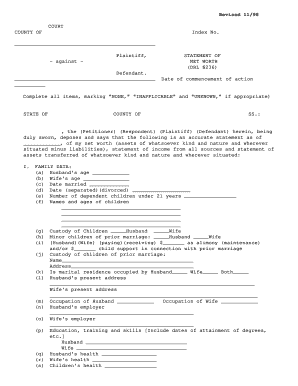

Personal Net Worth Statement

What is Personal Net Worth Statement?

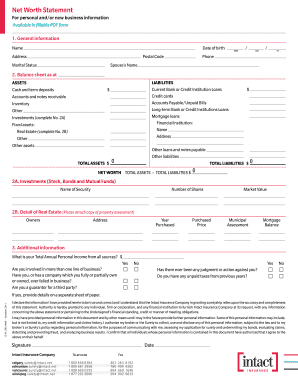

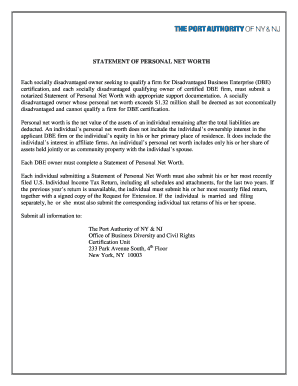

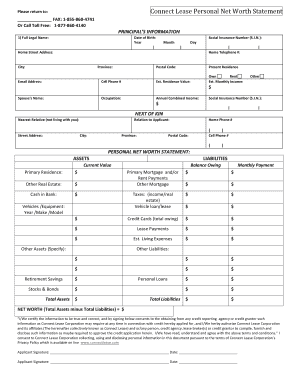

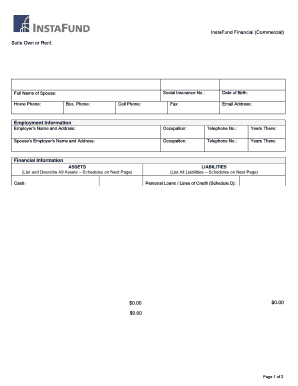

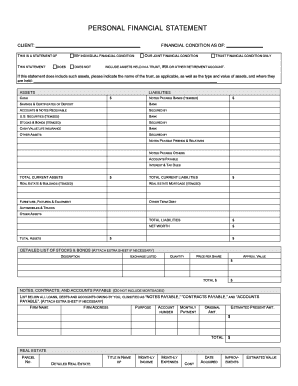

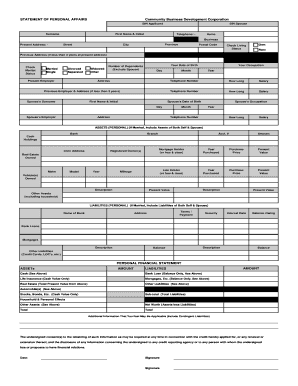

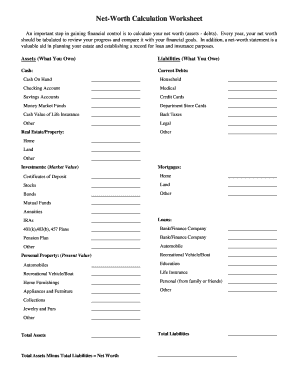

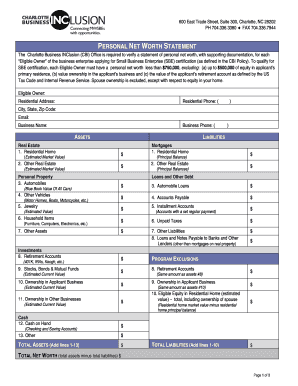

A Personal Net Worth Statement is a financial document that outlines an individual's assets, liabilities, and overall net worth. It provides a snapshot of an individual's financial situation at a specific point in time.

What are the types of Personal Net Worth Statement?

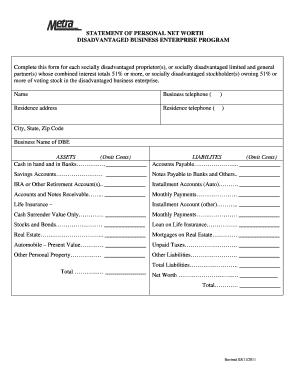

There are two main types of Personal Net Worth Statement: 1. Basic Net Worth Statement: This type includes essential financial information such as bank account balances, investments, real estate properties, and outstanding debts. 2. Detailed Net Worth Statement: In addition to the basic financial information, this type includes a more comprehensive breakdown of assets and liabilities, including detailed descriptions and current values.

How to complete Personal Net Worth Statement

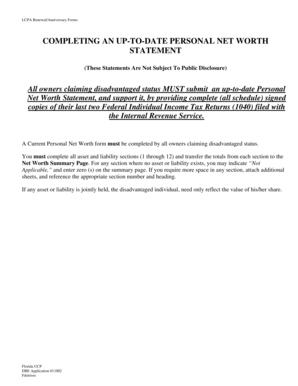

Completing a Personal Net Worth Statement can be a straightforward process by following these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.