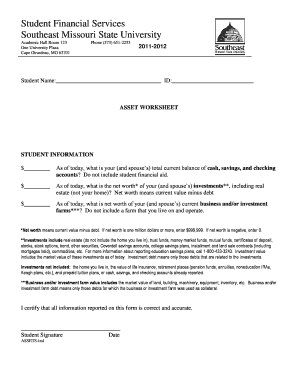

What is personal net worth worksheet?

A personal net worth worksheet is a financial tool that helps individuals calculate their net worth. It includes a detailed list of their assets, liabilities, and other financial information. By subtracting liabilities from assets, individuals can determine their net worth, which is a measure of their financial health and overall wealth.

What are the types of personal net worth worksheet?

There are various types of personal net worth worksheets available, each tailored to specific financial situations or goals. Some common types include:

Basic Personal Net Worth Worksheet: This worksheet includes essential categories such as cash, investments, real estate, and debts.

Business Net Worth Worksheet: Specifically designed for individuals with business interests, this worksheet includes additional sections for business assets, liabilities, and equity.

Retirement Net Worth Worksheet: Geared towards retirement planning, this worksheet focuses on assets and savings relevant to retirement, such as retirement accounts and investments.

Debt-to-Net Worth Ratio Worksheet: This worksheet calculates the ratio of an individual's debts to their net worth, providing insights into their financial leverage and risk level.

Customized Net Worth Worksheet: Depending on individual needs, customized net worth worksheets can be created by including specific categories relevant to personal financial situations.

How to complete personal net worth worksheet

Completing a personal net worth worksheet is a straightforward process that involves the following steps:

01

Gather all relevant financial documents, including bank statements, investment records, and loan statements.

02

List down all your assets, including cash, savings, investments, real estate, vehicles, and other valuable possessions, along with their estimated values.

03

Identify and list any liabilities you have, such as mortgages, loans, credit card debt, and outstanding bills.

04

Calculate the total value of your assets and liabilities.

05

Subtract the total value of liabilities from the total value of assets to determine your net worth.

06

Regularly update your personal net worth worksheet as your financial situation changes.

07

Consider seeking professional advice from a financial planner or accountant to ensure accuracy and better understand the implications of your net worth.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for users to efficiently manage their documents and streamline their workflows.