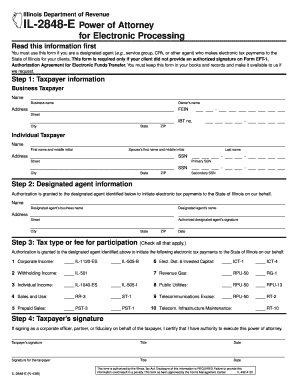

Power Of Attorney Form Irs - Page 2

What is power of attorney form irs?

A power of attorney form irs is a legal document that allows an individual or entity to appoint someone else to act on their behalf in matters related to their taxes. This form is specifically designed for interactions with the Internal Revenue Service (IRS), the government agency responsible for the collection of federal taxes. By filling out a power of attorney form irs, you are granting someone else the authority to represent you in tax matters, including filing tax returns, communicating with the IRS, and resolving any tax issues that may arise.

What are the types of power of attorney form irs?

There are different types of power of attorney form irs that cater to a variety of needs. These include:

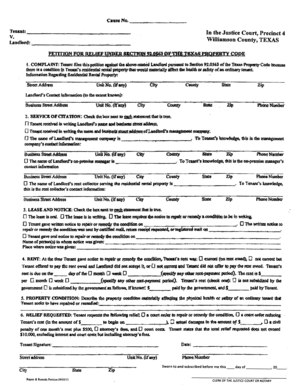

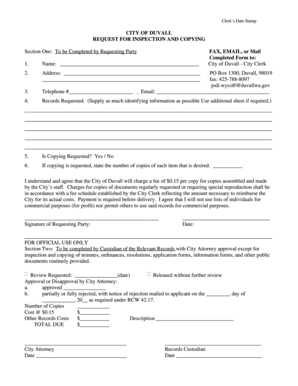

How to complete power of attorney form irs

Completing a power of attorney form irs is a straightforward process. Here are the steps you can follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.