Printable Mileage Log

What is Printable Mileage Log?

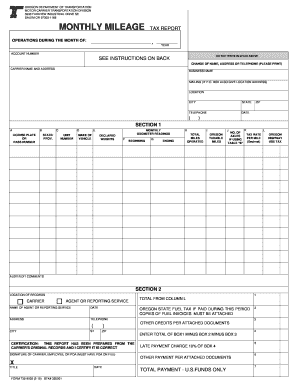

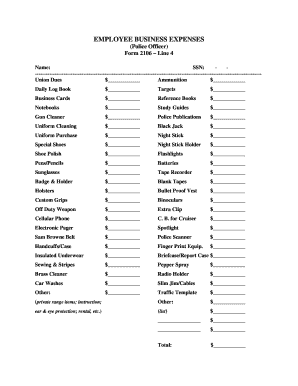

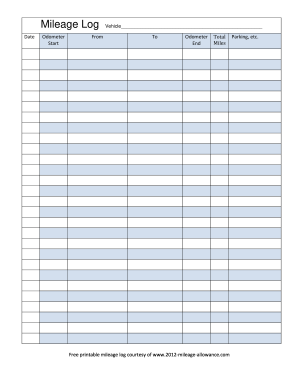

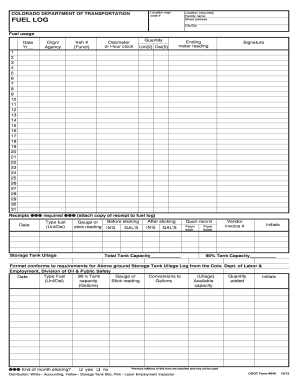

A Printable Mileage Log is a document used to keep track of the number of miles driven for business or personal purposes. It serves as a record to calculate deductible mileage expenses for business purposes or to monitor personal vehicle usage.

What are the types of Printable Mileage Log?

There are several types of Printable Mileage Logs available to suit different needs:

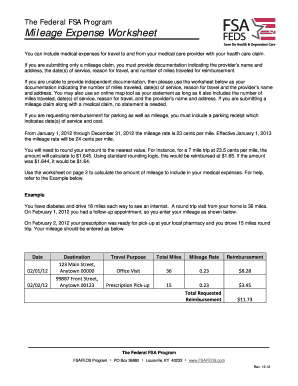

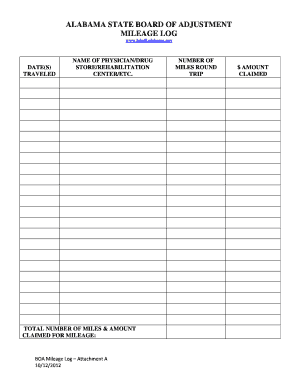

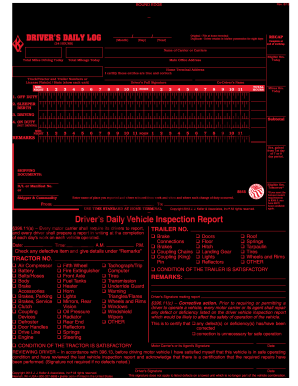

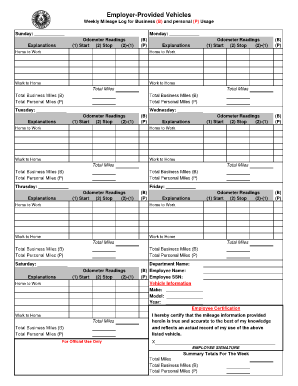

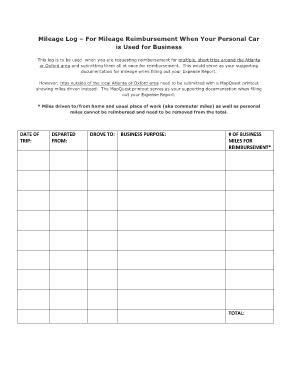

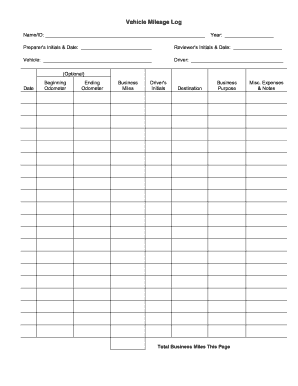

Basic Printable Mileage Log: This type of log includes fields to record the date, starting and ending odometer readings, total miles driven, and purpose of the trip.

Detailed Printable Mileage Log: This log provides additional fields to record specific details about each trip, such as the destination, client name, and any additional expenses incurred during the trip.

Electronic Printable Mileage Log: With the advancement of technology, electronic mileage logs are becoming popular. These logs can be stored and accessed digitally through apps or software, making it easier to track and categorize mileage records.

How to complete Printable Mileage Log

Completing a Printable Mileage Log is simple and straightforward. Here are the steps to follow:

01

Download or print a Printable Mileage Log template from a reliable source.

02

Fill in the date of each trip.

03

Record the starting and ending odometer readings for each trip.

04

Calculate the total miles driven by subtracting the starting reading from the ending reading.

05

Specify the purpose of the trip, whether it is for business or personal use.

06

If necessary, provide additional details such as the destination, client name, or any expenses incurred during the trip.

07

Regularly update and maintain the Printable Mileage Log to ensure accurate mileage records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Printable Mileage Log

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How does the IRS verify mileage?

The IRS defines adequate records for your mileage log Regardless of the circumstances of your employment, you will likely be asked to record the following: the mileage for each business use. the total mileage for the year. the time (date will do), place (your destination), and business purpose of each trip.

How do I set a mileage log?

According to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

Can you track mileage on paper?

You can use a paper log or a spreadsheet to track the mileage you've driven near the time of the trip - e.g. after each trip or at the end of the workday. You should always include the required details for each trip as described above - not just the distance, but the time, destination and purpose of the drive.

How do I create a mileage log?

According to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

Is it worth it to track mileage for taxes?

If you drive for work, mileage tracking is an indispensable part of your day. Tracking every work trip ensures that you maximize your tax deduction and the easiest way to make sure you do not miss out on that is by using an app to track miles.

What is the best way to record mileage for taxes?

How do you keep a mileage log? Keep a separate bank account or credit card for business expenses. This can be a great way to keep personal and driving expenses separated. Record mileage on paper or in a spreadsheet. Use a mile-tracking app. Use your Uber or Lyft app to track mileage deductions (not recommended).