Profit And Loss Statement For Self Employed

What is a profit and loss statement for self-employed?

A profit and loss statement, also known as an income statement, is a financial document that provides an overview of a self-employed individual's business income, expenses, and net profit or loss over a specific period of time. It is an essential tool for assessing the financial health of a self-employed business and understanding its profitability.

What are the types of profit and loss statement for self-employed?

There are two main types of profit and loss statements for self-employed individuals: single-step and multi-step. 1. Single-Step Profit and Loss Statement: This type of statement calculates the total revenue and subtracts the total expenses in a single step. It provides a simple and straightforward view of the net profit or loss. 2. Multi-Step Profit and Loss Statement: This type of statement breaks down revenue, expenses, and other financial details into multiple steps, allowing for a more detailed analysis of the business's financial performance.

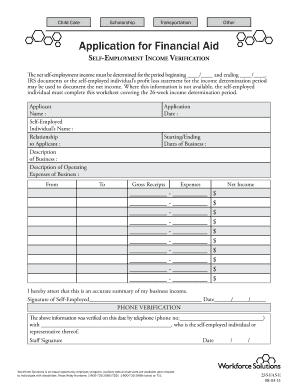

How to complete a profit and loss statement for self-employed

Completing a profit and loss statement for self-employed involves the following steps: 1. Gather all the necessary financial documents, such as income records, expense receipts, and bank statements. 2. Categorize your income and expenses into relevant categories, such as sales revenue, operating expenses, and cost of goods sold. 3. Calculate your total revenue by summing up all the income sources. 4. Calculate your total expenses by summing up all the expenses. 5. Subtract your total expenses from your total revenue to determine your net profit or loss. Remember to keep your profit and loss statement accurate and up-to-date for better financial management.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.