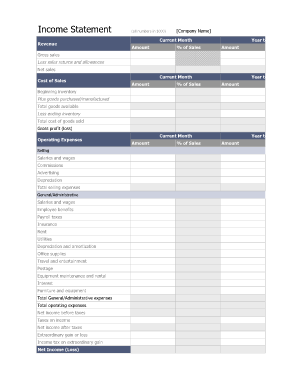

What is personal income statement template?

A personal income statement template is a document used to track and analyze an individual's income and expenses. It provides a comprehensive view of one's financial situation and helps in budgeting and financial planning.

What are the types of personal income statement template?

There are several types of personal income statement templates available to suit different needs and preferences. Some common types include:

Simple personal income statement template

Detailed personal income statement template

Monthly personal income statement template

Yearly personal income statement template

How to complete personal income statement template

Completing a personal income statement template is a straightforward process. Here are the steps to follow:

01

Gather all relevant financial documents, such as bank statements, pay stubs, and receipts.

02

List all sources of income, including wages, rental income, and investments.

03

Record all expenses, including fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment).

04

Calculate the net income by subtracting total expenses from total income.

05

Analyze the statement to identify areas of spending that can be reduced or optimized for better financial management.

06

Update the personal income statement regularly to accurately track changes in income and expenses.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you create a personal balance sheet and income statement?

How to create a personal balance sheet Step 1: Make a list of your ASSETS and where to get the most current values. Step 2: Make a list of your DEBTS and where to get the most current values. Step 3: Compile the information. Step 4: Categorize your total assets. Step 5: Categorize your total liabilities / debts.

What is considered a personal financial statement?

The term personal financial statement refers to a document or spreadsheet that outlines an individual's financial position at a given point in time. The statement typically includes general information about the individual, such as name and address, along with a breakdown of total assets and liabilities.

Does Excel have a financial statement template?

Q: Does Excel have financial templates? A: Yes. Excel has a range of financial templates, including income statements, cash flow statements, and balance sheets.

How do I prepare an income statement for myself?

How to Write an Income Statement Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income. Include Income Taxes.

How do I make a personal income statement?

To create a personal financial statement, follow these simple steps: Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

How do I fill out a personal financial statement?

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program. Step 2: Fill In Your Personal Information. Step 3: Write Down Your Assets. Step 4: Write Down Your Liabilities. Step 5: Fill Out the Notes Payable to Banks and Others Section. Step 6: Fill Out the Stocks and Bonds Section.

Related templates