Sample Financial Authorization Letter - Page 2

What is Sample Financial Authorization Letter?

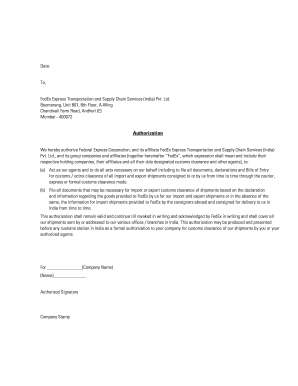

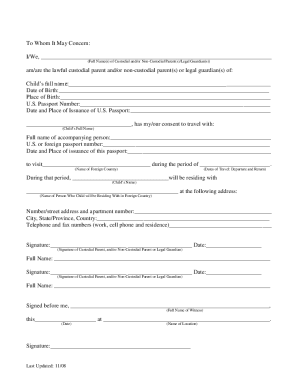

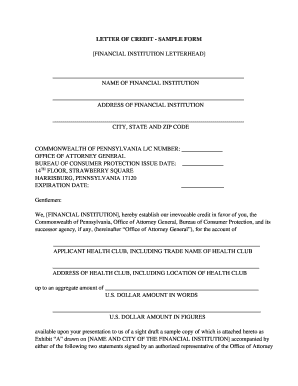

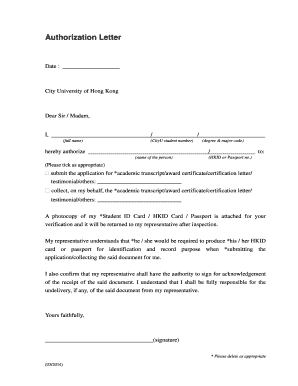

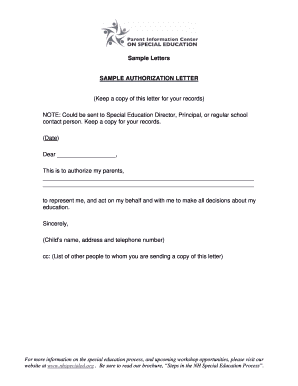

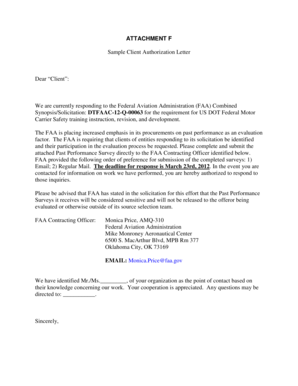

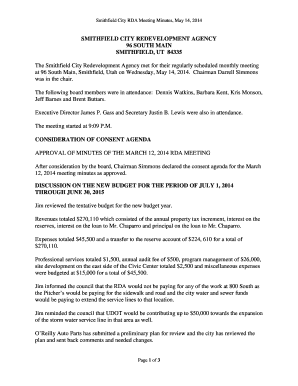

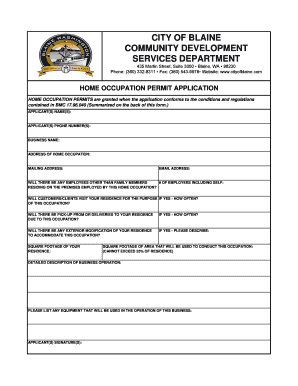

A Sample Financial Authorization Letter is a legal document that authorizes another person or organization to perform financial transactions on behalf of the person or entity mentioned in the letter. It serves as a written consent for someone to act as a representative in financial matters such as banking, signing documents, or making financial decisions.

What are the types of Sample Financial Authorization Letter?

There are various types of Sample Financial Authorization Letters depending on the specific financial tasks and arrangements involved. Some common types include: 1. Bank Account Authorization Letter: This type of letter grants authorization to another person to access and manage a specific bank account on behalf of the account holder. 2. Investment Authorization Letter: This letter allows someone to make investment decisions or execute investment transactions on behalf of the authorizing entity. 3. Tax Authorization Letter: This letter provides authorization for someone to handle tax-related matters, such as filing taxes or accessing tax information, on behalf of the taxpayer. 4. Loan Authorization Letter: This type of letter grants permission for another person or organization to apply for a loan or handle loan-related tasks on behalf of the authorizing party. 5. Financial Power of Attorney: This is a comprehensive authorization letter that grants broad financial powers to the appointed representative, allowing them to handle all financial matters of the authorizing party.

How to complete Sample Financial Authorization Letter

Completing a Sample Financial Authorization Letter involves several key steps: 1. Start with the date and address: Begin the letter with the current date and the complete address of the party issuing the authorization letter. 2. Add recipient details: Include the complete name, address, and contact information of the person or organization being authorized. 3. State the purpose: Clearly state the purpose of the authorization letter, specifying the financial tasks and responsibilities the authorized party will have. 4. Specify limitations (if any): If there are any limitations or specific conditions associated with the authorization, clearly mention them in the letter. 5. Include necessary details: Provide any necessary account numbers, identification information, or supporting documents required for the authorized party to carry out the requested financial tasks. 6. Sign the letter: The authorized person or party should sign the letter, and it may also require notarization depending on the specific requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.