What is Sample Promissory Note?

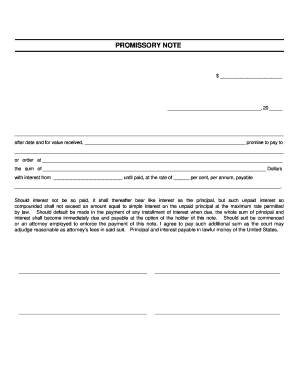

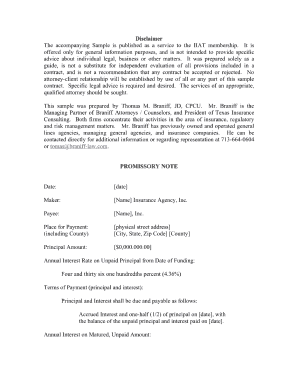

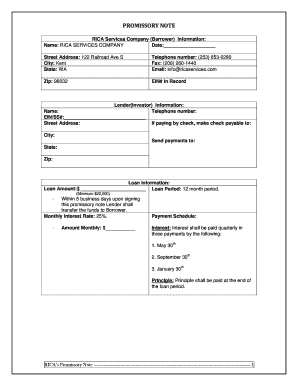

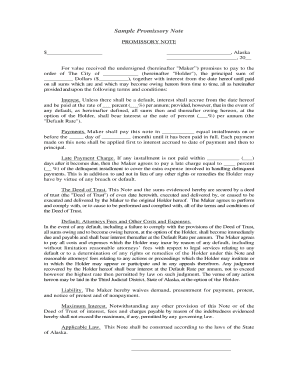

A Sample Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender within a certain period of time. It includes important details such as the loan amount, interest rate, repayment terms, and consequences of defaulting on the loan.

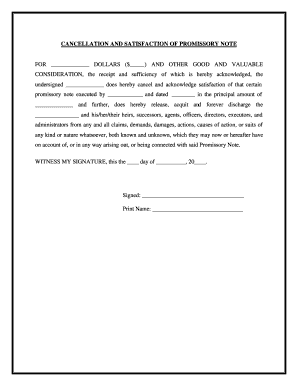

What are the types of Sample Promissory Note?

There are several types of Sample Promissory Notes depending on the specific circumstances and agreements between the borrower and lender. Some common types include:

Simple Promissory Note: A straightforward note with basic loan terms and repayment plan.

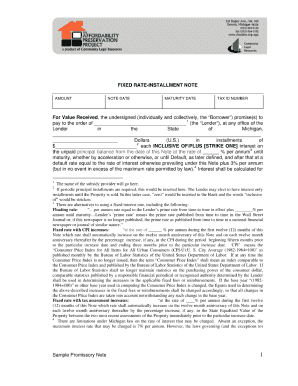

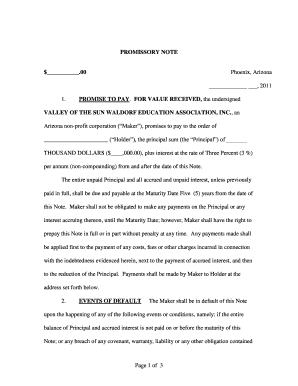

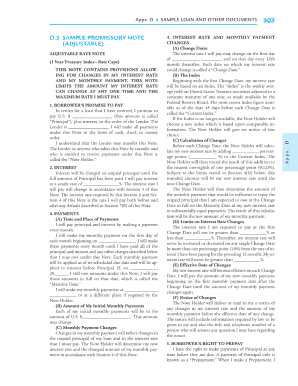

Installment Promissory Note: This type allows borrowers to repay the loan amount in regular installments over a fixed period of time.

Balloon Promissory Note: In this type, the borrower makes smaller payments initially and a large lump sum payment at the end of the loan term.

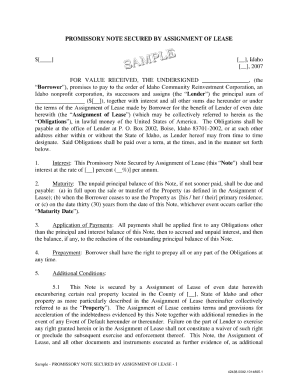

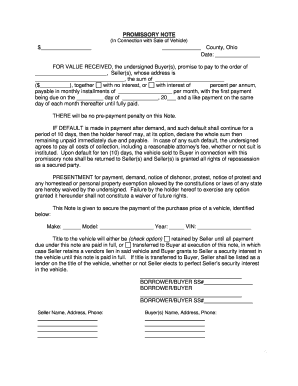

Secured Promissory Note: A note that includes collateral, such as property or assets, which the lender can claim in case of default.

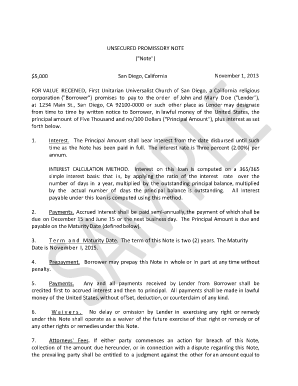

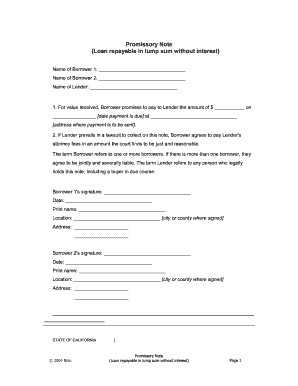

Unsecured Promissory Note: This note does not require collateral and relies solely on the borrower's creditworthiness.

How to complete Sample Promissory Note

Completing a Sample Promissory Note is a straightforward process. Here's a step-by-step guide:

01

Enter the names and contact information of the borrower and lender.

02

Specify the loan amount and the desired repayment terms, including the interest rate and payment due dates.

03

Include any additional terms or conditions agreed upon between the borrower and lender.

04

Review the completed Sample Promissory Note for accuracy and make any necessary revisions.

05

Both the borrower and lender should sign and date the document to make it legally binding.

06

Keep a copy of the Sample Promissory Note for future reference.

pdfFiller, a leading online document management platform, empowers users to easily create, edit, and share documents, including Sample Promissory Notes, with ease. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users can rely on to get their documents done efficiently and securely.