How To Write A Promissory Note

What is how to write a promissory note?

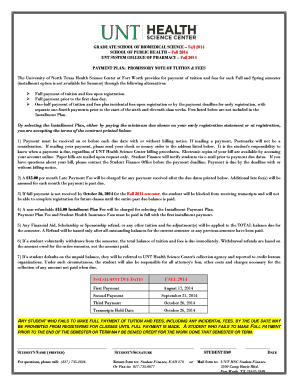

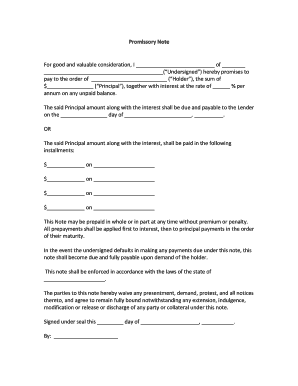

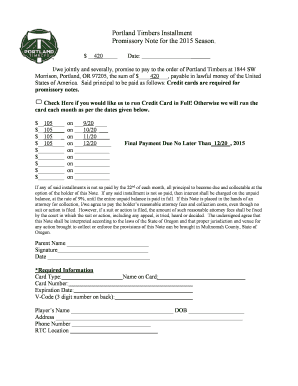

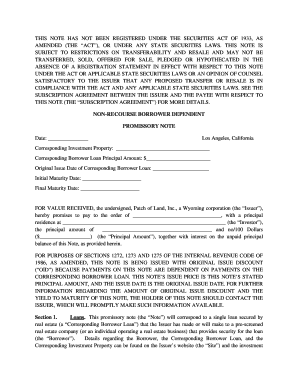

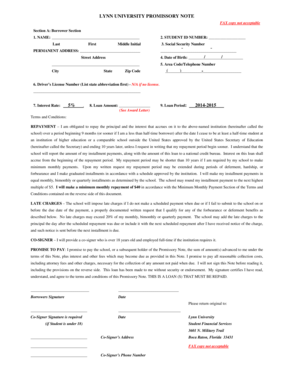

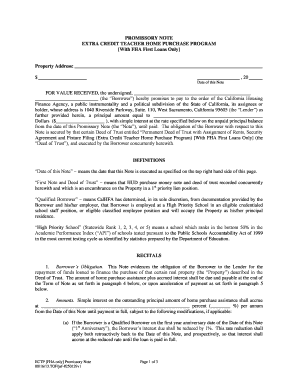

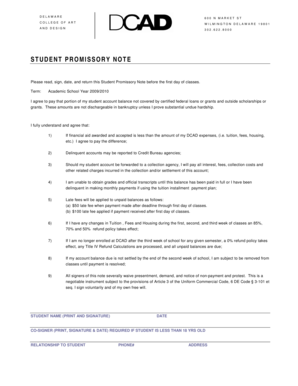

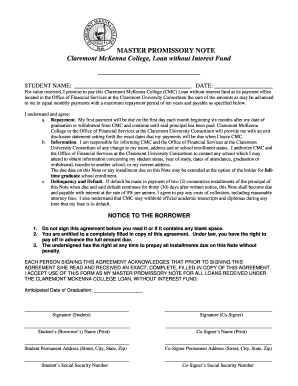

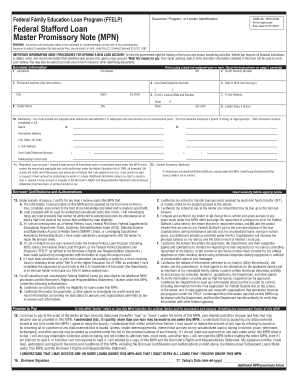

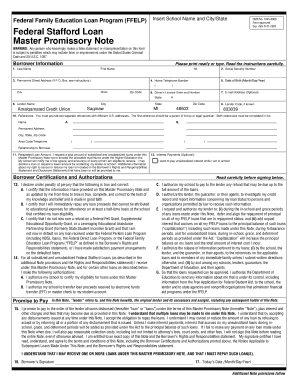

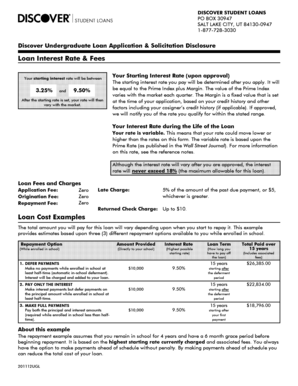

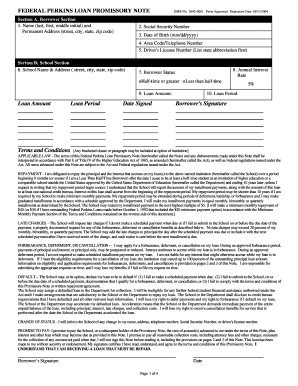

A promissory note is a legally binding document that contains a written promise to repay a debt. It outlines the terms and conditions of the loan agreement, including the amount borrowed, the interest rate, and the repayment schedule. When writing a promissory note, it is important to include the names of both the borrower and the lender, as well as the date of the loan and the agreed-upon terms. By having a clear and detailed promissory note, both parties can protect their interests and ensure that the loan is repaid as agreed upon.

What are the types of how to write a promissory note?

There are several types of promissory notes that can be used depending on the specific circumstances. Some common types include:

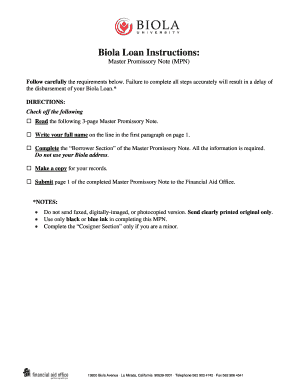

How to complete how to write a promissory note

To complete a promissory note, follow these steps:

By following these steps, you can create a complete and enforceable promissory note that protects the interests of both the borrower and the lender. Remember to carefully review the note before signing it and consider seeking legal advice if you have any questions or concerns. And don't forget, pdfFiller is here to simplify the process by empowering users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your promissory note done quickly and easily.