Promissory Note Florida

What is promissory note Florida?

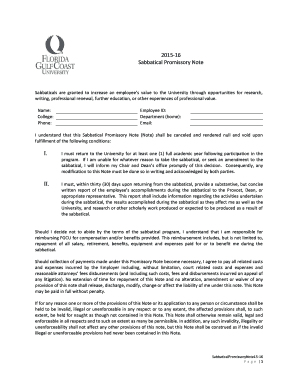

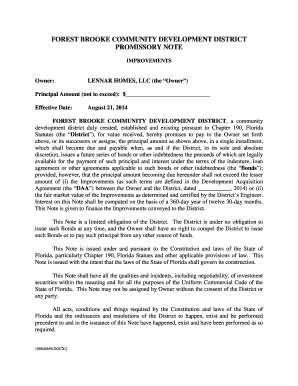

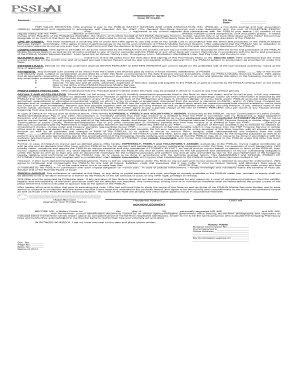

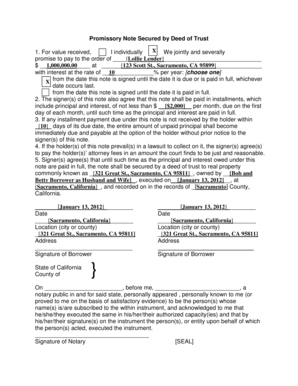

A promissory note Florida is a legally binding document that outlines the terms of a loan agreement between a borrower and a lender. It serves as a written promise by the borrower to repay a specific amount of money by a certain date.

What are the types of promissory note Florida?

In Florida, there are two common types of promissory notes: unsecured promissory notes and secured promissory notes.

Unsecured promissory note - This type of note does not require any collateral from the borrower. If the borrower fails to repay the loan, the lender can take legal action to recover the funds.

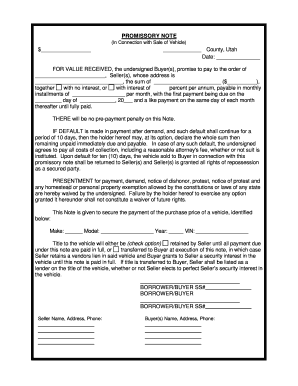

Secured promissory note - This type of note is backed by collateral, such as property or a vehicle. If the borrower defaults on the loan, the lender has the right to seize the collateral to recover the debt.

How to complete promissory note Florida

Completing a promissory note in Florida is a straightforward process. Here are the steps to follow:

01

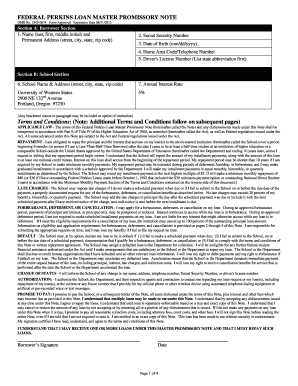

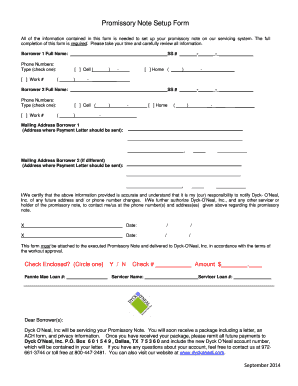

Identify the parties involved - Clearly state the names and roles of the borrower and lender.

02

Specify the loan terms - Outline the loan amount, interest rate, repayment schedule, and any late fees or penalties.

03

Include any additional terms - This could include provisions for early repayment, loan extensions, or default consequences.

04

Sign and date the document - Both parties must sign and date the promissory note to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What makes a promissory note invalid in Florida?

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Does a promissory note have to be witnessed?

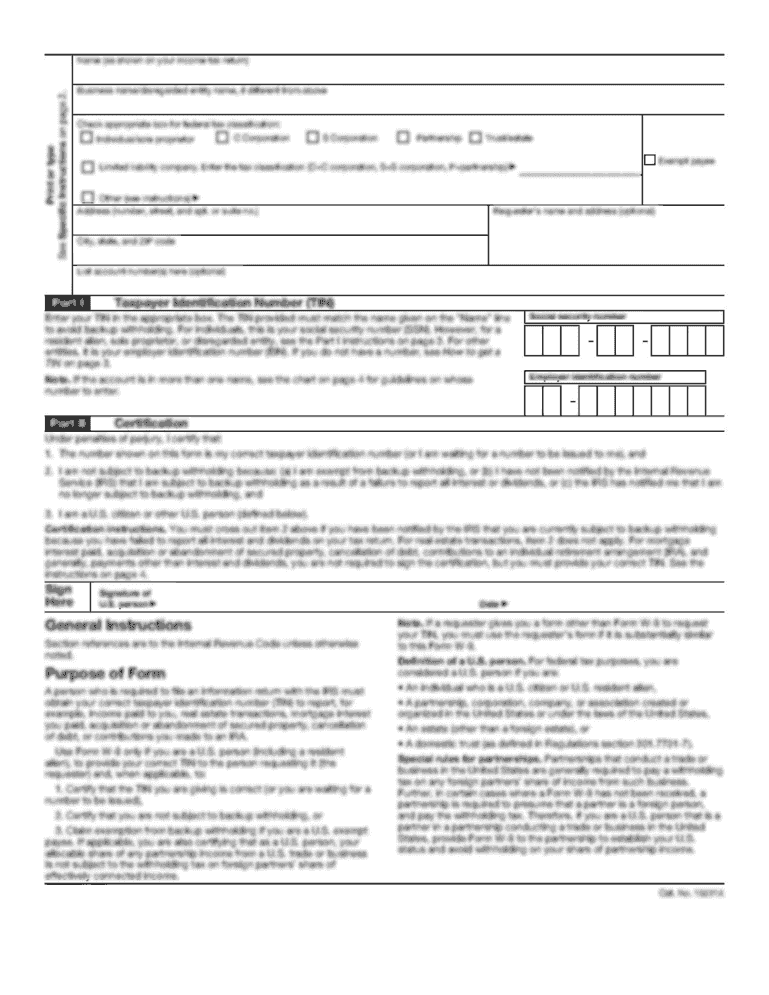

In order for a promissory note to be legally binding, it must include the signature of the borrower. You generally are not required by law to have the signatures witnessed or notarized.

How do you write a perfect promissory note?

A secured promissory note should carefully outline its repayment, and default terms. For example, it should spell out the steps required for seizing collateral. It should also state if there are any grace periods for late payments, and name who shall pay for costs, and legal fees if there is a default.

What are the requirements for a promissory note to be valid?

Promissory Notes - The Basics Identification of Parties. Amount owed and interest to be charged. Date of payments. Right to assign (transfer the obligation to another.) Place the Note is entered into and to be enforced. Signature Line.

What are the rules of promissory note?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Is a promissory note valid if it is not notarized?

Does a promissory note have to be notarized? A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

Related templates