Simple Promissory Note No Interest

What is simple promissory note no interest?

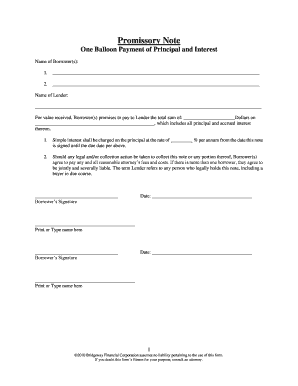

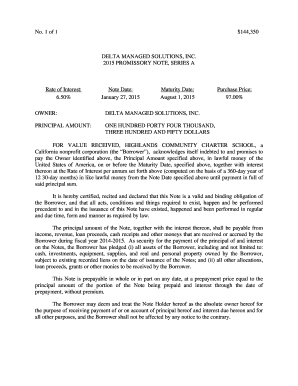

A simple promissory note no interest is a legal document that outlines the terms of a loan agreement between two parties. Unlike traditional promissory notes that may include an interest rate, a simple promissory note no interest does not require the borrower to pay any additional fees or interest on the borrowed amount. This type of promissory note is commonly used when the lender wants to provide financial assistance to the borrower without charging any interest.

What are the types of simple promissory note no interest?

There are several types of simple promissory note no interest that can be used, depending on the specific needs of the parties involved. These may include: 1. Personal promissory note: This type of promissory note is used for personal loans between family members or friends. 2. Business promissory note: This type of promissory note is used for loans between businesses or business partners. 3. Student promissory note: This type of promissory note is used for educational loans between a student and a lender.

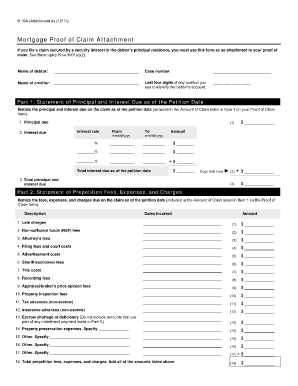

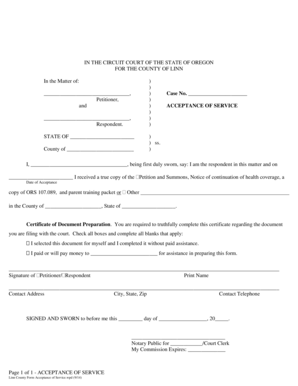

How to complete simple promissory note no interest

Completing a simple promissory note no interest is a straightforward process. Here are the steps: 1. Begin by identifying the parties involved: Include the full names, addresses, and contact information of both the lender and the borrower. 2. Specify the loan amount: Clearly state the exact amount of money that is being loaned. 3. Define the repayment terms: Indicate the duration of the loan and how the borrower will repay the borrowed amount. 4. Include any additional terms: If there are any additional conditions or requirements for the loan, be sure to include them. 5. Sign and date the promissory note: Both the lender and the borrower should sign and date the document to make it legally binding.

pdfFiller is a reliable online tool that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and hassle-free.