Small Estate Affidavit California 2017

What is small estate affidavit california 2017?

A small estate affidavit is a legal document that allows heirs to claim the assets of a deceased person without going through the probate process. In California, the small estate affidavit for 2017 is a specific version of this document that is applicable to estates with a total value of $150,000 or less.

What are the types of small estate affidavit california 2017?

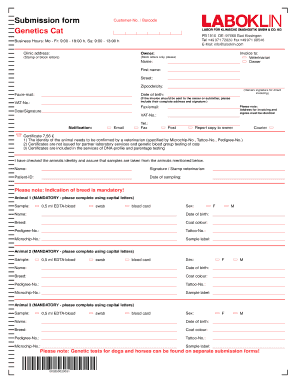

In California, there are two types of small estate affidavit for 2017: 1. Affidavit for Collection of Personal Property: This type of affidavit can be used when the total value of the estate, excluding real estate, is $150,000 or less. 2. Affidavit for Transfer of Personal Property: This type of affidavit can be used when the total value of the estate, including real estate, is $150,000 or less.

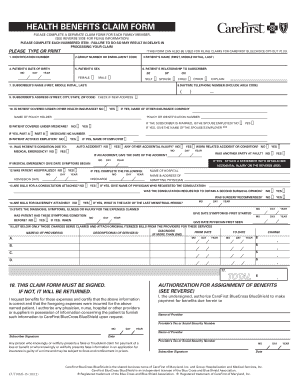

How to complete small estate affidavit california 2017

To complete a small estate affidavit in California for 2017, follow these steps: 1. Obtain the small estate affidavit form specific to your situation (Collection or Transfer). 2. Provide the necessary information about the deceased person, their assets, and their heirs. 3. Sign the affidavit in the presence of a notary public. 4. Attach any required supporting documents, such as a death certificate or proof of ownership. 5. File the completed affidavit with the appropriate county court. 6. Wait for the court's approval and the issuance of Letters of Administration or Letters Testamentary. 7. Use the approved affidavit to claim and distribute the assets of the estate.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.