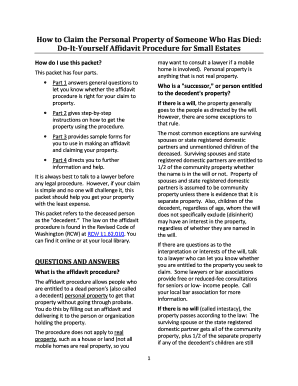

Small Estate Affidavit Indiana

What is small estate affidavit indiana?

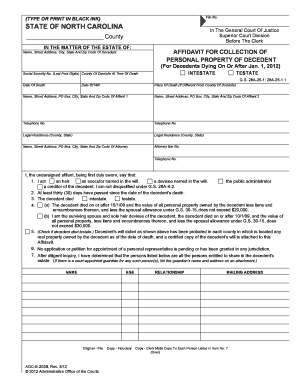

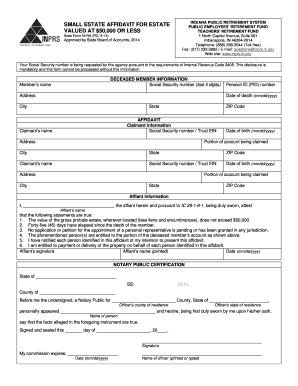

A small estate affidavit in Indiana is a legal document used to transfer ownership of real estate or personal property when the value of the estate is below a certain threshold. It allows for a simplified probate process, bypassing the need for a formal court proceeding. The affidavit must be filed with the appropriate county clerk's office in Indiana.

What are the types of small estate affidavit indiana?

In Indiana, there are two types of small estate affidavits: one for real estate and one for personal property. The real estate affidavit is used when the deceased person owned real property, such as land or buildings. The personal property affidavit is used for all other types of property, such as bank accounts, vehicles, or personal belongings.

How to complete small estate affidavit indiana

To complete a small estate affidavit in Indiana, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.