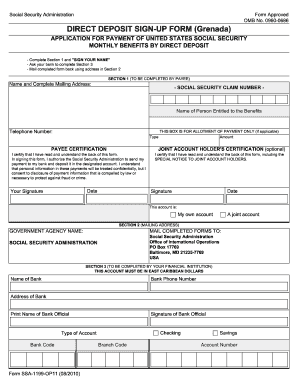

Social Security Direct Deposit Forms

What is social security direct deposit forms?

Social security direct deposit forms are the official documents used by individuals to provide their banking information to the Social Security Administration. These forms allow recipients to receive their social security benefits directly into their bank accounts, eliminating the need for physical checks.

What are the types of social security direct deposit forms?

There are two main types of social security direct deposit forms: the SSA-1199 form for federal benefit payments and the SF 1199A form for all other types of payments. Both forms require individuals to fill out their personal and banking information to authorize direct deposit.

How to complete social security direct deposit forms

Completing social security direct deposit forms is a simple process that can be done in a few easy steps. You will need to provide your name, social security number, banking information, and select the type of payment you are receiving. Once you have filled out the form, make sure to double-check all information before submitting it to the Social Security Administration.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.