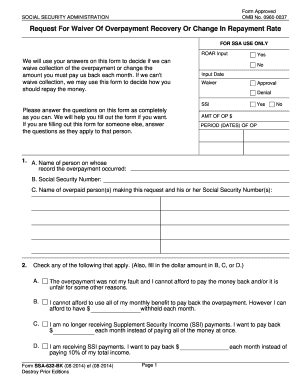

Ssa-632

What is ssa-632?

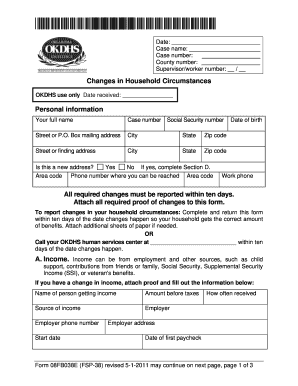

SSA-632 is a form issued by the Social Security Administration (SSA) in the United States. It is used to report changes in the applicant's income, resources, or living arrangements that could affect their eligibility for Supplemental Security Income (SSI) benefits.

What are the types of ssa-632?

There are three main types of SSA-632 forms:

SSA-632-BK: This form is used for reporting changes in living arrangements.

SSA-632-FThis form is used for reporting changes in income.

SSA-632-UThis form is used for reporting changes in resources.

How to complete ssa-632

Completing an SSA-632 form is a straightforward process. Here are the steps to follow:

01

Gather all necessary information and documents related to the changes you need to report.

02

Download the appropriate SSA-632 form from the Social Security Administration's official website or obtain a physical copy from your local SSA office.

03

Carefully read the instructions provided with the form to ensure you understand the requirements and provide accurate information.

04

Fill out the form digitally or manually, depending on your preference.

05

Double-check all the information you have entered to avoid any mistakes or missing details.

06

Sign and date the completed form.

07

Submit the form to the Social Security Administration either online or by mail, following the provided instructions.

08

Keep a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out ssa-632

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is Social Security overpayment dischargeable?

Essentially, a Social Security overpayment is a debt you have to pay back. But like most debts, absent fraud, Social Security overpayments are typically dischargeable in bankruptcy.

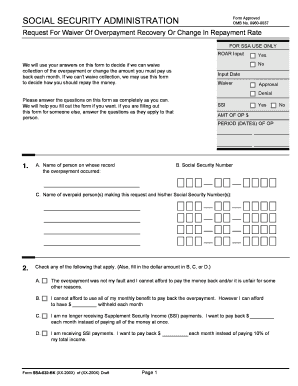

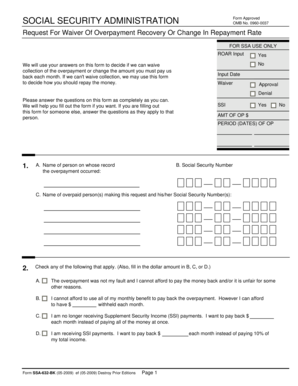

How do I waive overpayment for Social Security?

If you believe that you may have been overpaid, but feel that it was not your fault and you cannot afford to pay us back: ask for a waiver of the overpayment. and. ask for and complete form SSA 632 (Request for Waiver of Overpayment Recovery).

What does it mean to waive an overpayment?

If Social Security decides to waive the overpayment, this means that you do not have to repay the money to Social Security. Social Security should also refund any part of the overpayment that they already collected from you.

How do I get a waiver for overpayment on Social Security?

If you agree that you have been overpaid, but you feel you should not have to pay it back because you did not cause the overpayment and you cannot afford to repay it, you should file Form SSA-632, Request for Waiver of Overpayment Recovery.

What is a SSA 632?

Purpose of the SSA-632 We use the SSA-632 to collect pertinent information about the overpaid person and his or her household members, if any, when the overpaid person requests a waiver of overpayment recovery. The overpaid person or a person representing the overpaid person can complete the SSA-632.

How do I send Form SSA 632?

Send the completed forms to your local Social Security office. If you have any questions, you may call us toll-free at 1-800-772-1213 Monday through Friday from 7 a.m. to 7 p.m. If you are deaf or hard of hearing, you may call our TTY number, 1-800-325-0778.

Related templates