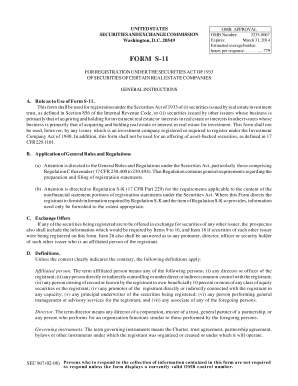

Ssa-11

What is ssa-11?

SSA-11 refers to the Social Security Administration form 11. It is a form used by the Social Security Administration to gather information about an individual's work history and employment status. The form is used to determine eligibility for various Social Security benefits and programs.

What are the types of ssa-11?

There are several types of SSA-11 forms that cater to specific purposes. These include:

SSA-11-BK: Application for Reconsideration of Disability Decision

SSA-11-FRequest for Additional Information

SSA-11-FRequest for Hearing by Administrative Law Judge

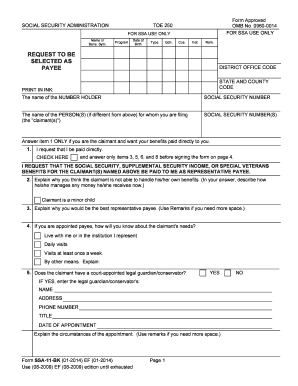

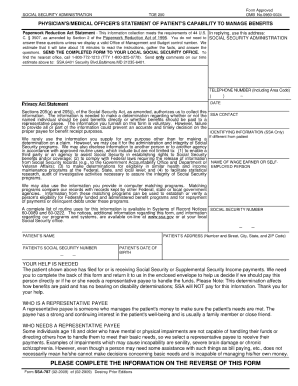

SSA-Request to be selected as Representative Payee

How to complete ssa-11

To complete SSA-11 form, follow these steps:

01

Provide personal information such as name, Social Security number, contact details, and date of birth.

02

Fill in details about your employment history, including names and addresses of employers, job titles, and dates of employment.

03

Indicate if you have previously applied for any Social Security benefits.

04

Provide additional information or attachments as requested by the specific type of SSA-11 form you are completing.

05

Sign and date the form.

06

Submit the completed form to the appropriate Social Security Administration office.

pdfFiller is a powerful online platform that empowers users to create, edit, and share documents seamlessly. With unlimited fillable templates and robust editing tools, pdfFiller is the top choice for all your PDF editing needs.

Video Tutorial How to Fill Out ssa-11

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

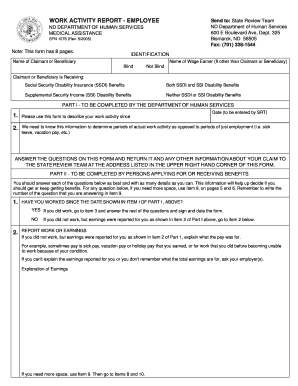

Can I fill out the representative payee report Online?

You must be 18 or older to complete the Representative Payee Accounting Report online. If you are under 18 and a representative payee, you must complete the paper Representative Payee Report form you received in the mail and return it to the address shown on the form.

How do I fill out a representative payee report for Social Security?

You must complete form SSA-11 (Request to be selected as payee) and show us documents to prove your identity. You will need to provide your social security number, or if you represent an organization, the organization's employer identification number.

How do I fill out form SSA 11?

To complete an SSA 11-BK, you will need to provide the following information: Name of the number holder. Social security number. Name of the person(s) for whom you are filing (claimant) Claimant's social security number. Indication if you are the claimant and what your benefits paid directly to you.

How do I fill out a representative payee report?

Representative payees can fill out the form and return it to Social Security by mail, or conveniently file it online at www.ssa.gov/myaccount/rep-payee.html. Organizational representative payees are able to complete their Representative Payee Report online by using Business Services Online.

How do I complete a representative payee in accounting report online?

Representative payees can fill out the form and return it to Social Security by mail, or conveniently file it online at www.ssa.gov/myaccount/rep-payee.html. Organizational representative payees are able to complete their Representative Payee Report online by using Business Services Online.

What disqualifies you from being a payee for Social Security?

A representative payee applicant may not serve if he/she: (a) Has been convicted of a violation under section 208, 811 or 1632 of the Social Security Act. (b) Has been convicted of an offense resulting in imprisonment for more than 1 year.

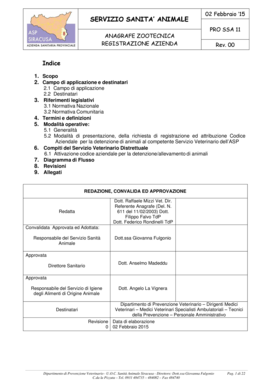

Related templates