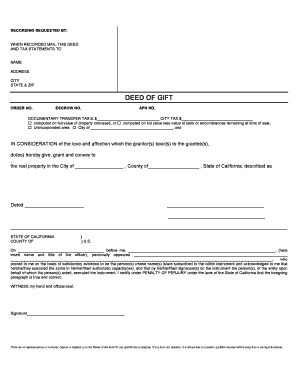

What is State Of Texas Gift Deed?

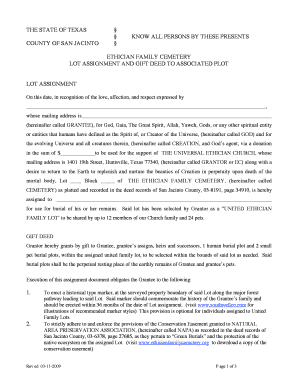

A State of Texas Gift Deed is a legal document that allows an individual to transfer ownership of real estate as a gift to another person. It is commonly used when a property owner wants to gift their property to a family member, friend, or charitable organization. By executing a Gift Deed, the property owner relinquishes their rights to the property and transfers it to the recipient without any payment in return. This type of transfer must comply with the specific requirements outlined by the State of Texas.

What are the types of State Of Texas Gift Deed?

There are different types of State of Texas Gift Deeds that individuals can choose from based on their specific needs. Some common types include:

General Warranty Deed: This type of Gift Deed provides the highest level of protection for the recipient as it guarantees that the property is free from any defects or claims.

Special Warranty Deed: Similar to a General Warranty Deed, but with limited warranties. It only provides protection against defects or claims that occurred during the ownership of the property by the giver.

Quitclaim Deed: This type of Gift Deed transfers the ownership rights of the property without providing any warranties or guarantees. It is often used when the giver wants to transfer their interest in the property, but does not want to guarantee the property's title.

Life Estate Deed: This type of Gift Deed allows the giver to transfer the property to a recipient while retaining the right to use and possess the property until their death. After the giver's death, the property transfers fully to the recipient.

How to complete State Of Texas Gift Deed

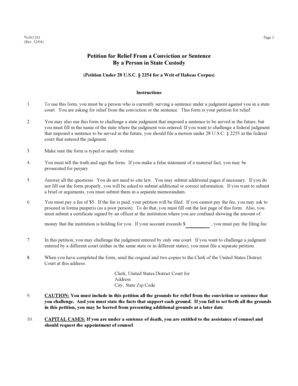

Completing a State of Texas Gift Deed involves several steps to ensure a legally valid transfer of property. Here is a step-by-step guide:

01

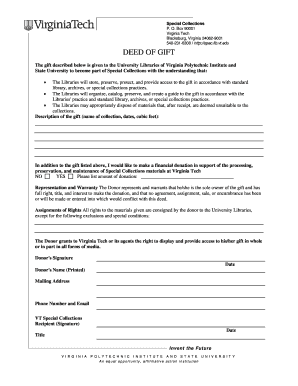

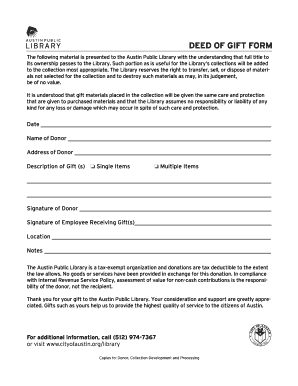

Obtain the official State of Texas Gift Deed form: The form can be obtained from the county recorder's office or downloaded from the official website of the State of Texas.

02

Provide necessary information: Fill in the required details, including the names and addresses of the giver and recipient, legal description of the property, and any specific conditions or restrictions if applicable.

03

Sign the document: Both the giver and recipient must sign the Gift Deed in the presence of a notary public. The notary public will acknowledge the signatures to make the document legally binding.

04

Record the Gift Deed: File the completed and notarized Gift Deed with the county recorder's office in the county where the property is located. Pay the required fees for recording.

05

Notify relevant parties: Notify any mortgage lenders, homeowners' associations, or other parties with an interest in the property about the transfer of ownership.

06

Consider consulting an attorney: It may be advisable to consult with a legal professional to ensure compliance with all applicable laws and to address any specific concerns or requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.