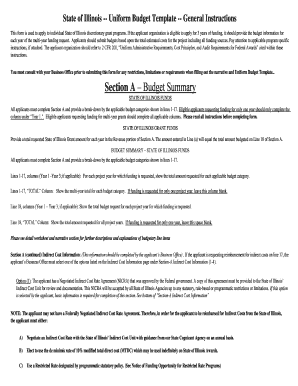

What is Student Budget?

A student budget refers to a financial plan that helps students manage their expenses and income effectively. It involves tracking and allocating money for various necessities and discretionary items, ensuring that students can cover all essential costs without overspending. With a well-thought-out student budget, individuals can prioritize their spending, save money, and avoid unnecessary debt.

What are the types of Student Budget?

There are several types of student budgets that cater to different needs and financial situations. Some common types include:

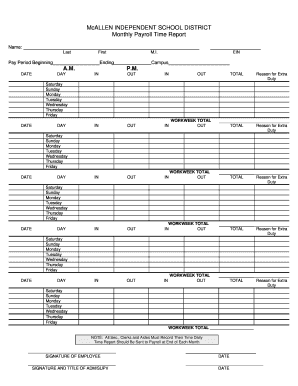

Weekly Budget: This budget is designed to track and manage expenses and income on a weekly basis. It helps students stay on top of their finances and make necessary adjustments throughout the month.

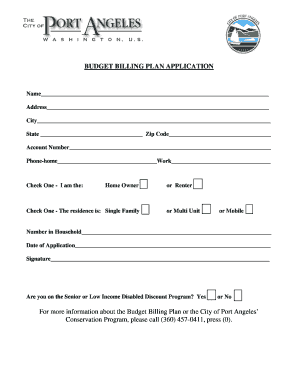

Monthly Budget: This budget covers expenses and income for a whole month. It is ideal for students who receive monthly allowances or have a stable source of income.

Fixed Budget: A fixed budget allocates a predetermined amount of money for each expense category. This type of budget helps students set and stick to specific spending limits.

Flexible Budget: A flexible budget allows for adjustments and changes in spending categories depending on the circumstances. It provides more freedom and adaptability in managing expenses.

How to complete Student Budget

Completing a student budget can be done in a few simple steps:

01

Calculate Income: Start by determining your total income from sources such as part-time jobs, allowances, scholarships, and financial aid.

02

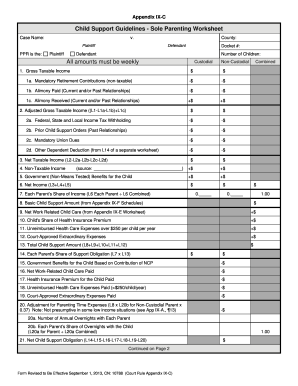

List Expenses: Make a comprehensive list of all your expenses, including rent, utilities, groceries, transportation, tuition fees, textbooks, and other discretionary spending.

03

Assign Budget Categories: Categorize your expenses into different categories, such as housing, food, education, entertainment, and miscellaneous. Allocate a specific percentage or amount of your income to each category.

04

Track Spending: Keep a record of your daily expenses and compare them to your budget. Regularly review and adjust your spending habits to ensure you stay within your allocated limits.

05

Save and Prioritize: Set aside a portion of your income as savings to build an emergency fund. Prioritize essential expenses and consider cutting back on non-essential ones to save more money.

06

Utilize Technology: Take advantage of online tools and budgeting apps to simplify the process and track your budget more efficiently. pdfFiller, for instance, empowers users to create, edit, and share documents online, including budget spreadsheets.

07

Review and Revise: Periodically review your budget to assess your financial progress and make necessary adjustments. Prioritize financial stability and aim to improve your budgeting skills over time.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.