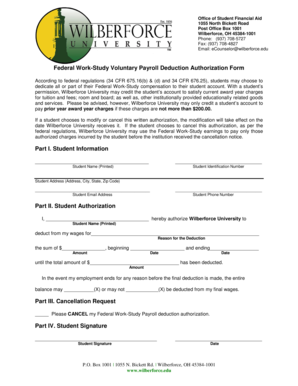

Voluntary Payroll Deduction Authorization Form - Page 2

What is a Voluntary Payroll Deduction Authorization Form?

A voluntary payroll deduction authorization form is a document that allows employees to authorize their employer to deduct a specific amount of money from their paycheck. This deduction is voluntary and can be used for various purposes, such as contributions to retirement plans, health insurance premiums, or charitable donations. By completing this form, employees give their consent and provide instructions to their employer regarding the deduction.

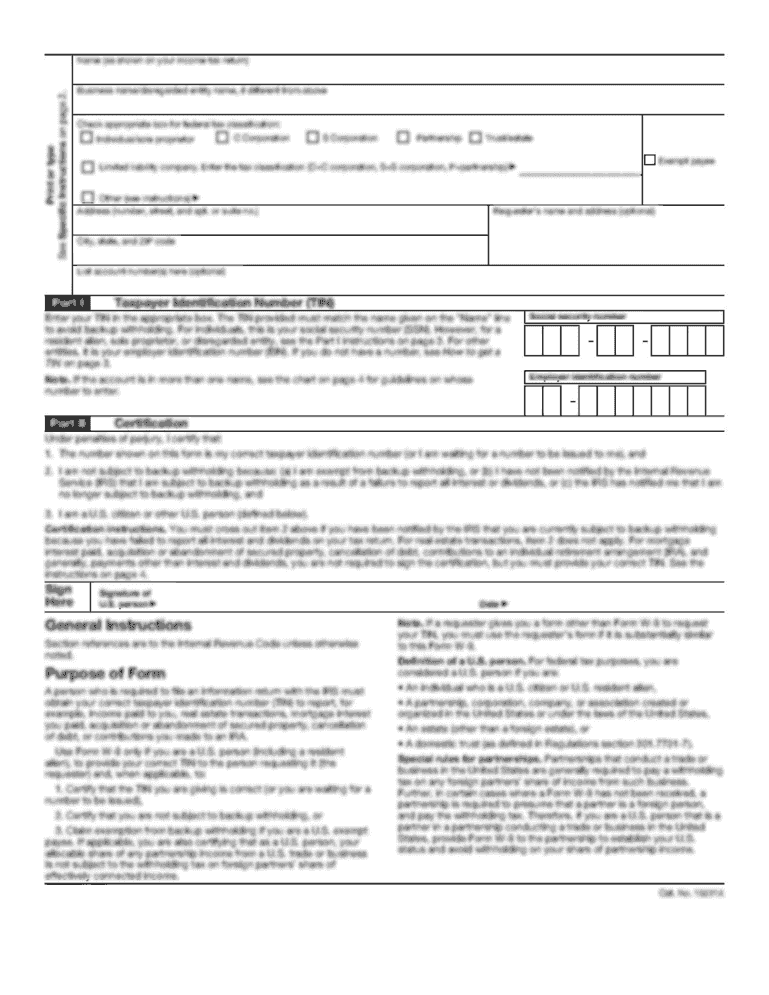

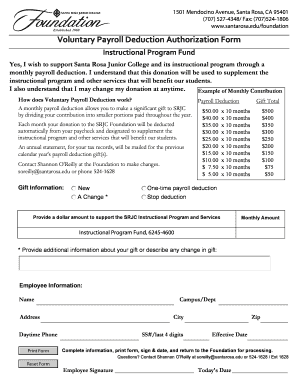

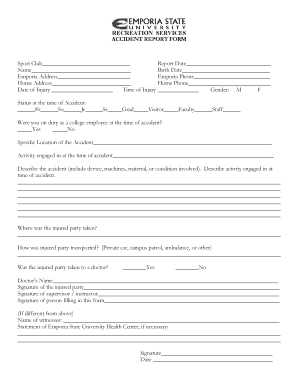

Types of Voluntary Payroll Deduction Authorization Form

There are several types of voluntary payroll deduction authorization forms that cater to different purposes and benefits. Some common types include:

How to Complete Voluntary Payroll Deduction Authorization Form

Completing a voluntary payroll deduction authorization form is a straightforward process. Here are the steps to follow:

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller ensures that users have everything they need to get their documents done efficiently and effectively.