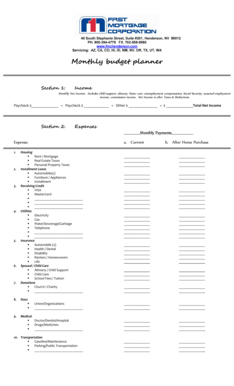

Weekly Budget Planner

What is Weekly Budget Planner?

A Weekly Budget Planner is a tool used to track and manage expenses for a specific week. It helps individuals and businesses plan their budget, track their spending, and ensure they stay within their financial limits.

What are the types of Weekly Budget Planner?

There are several types of Weekly Budget Planners available to suit different needs. Some common types include:

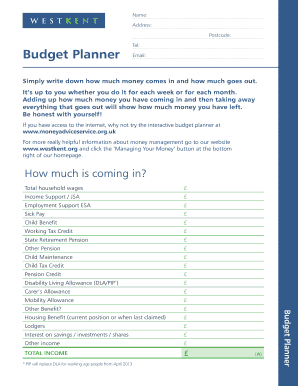

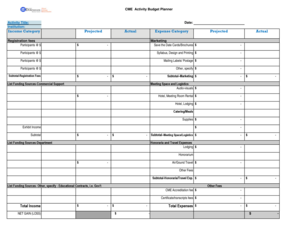

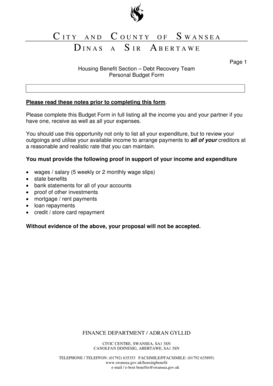

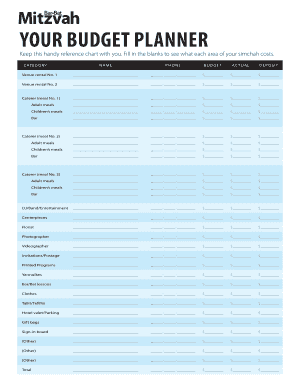

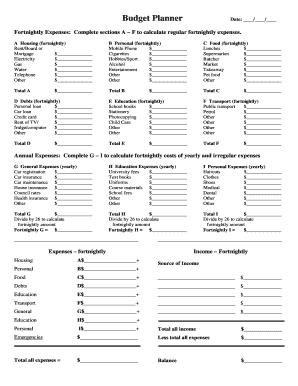

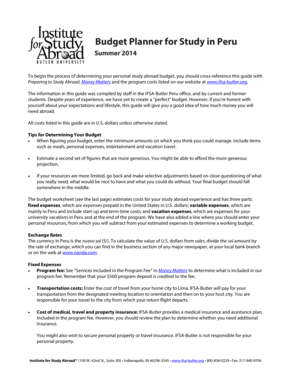

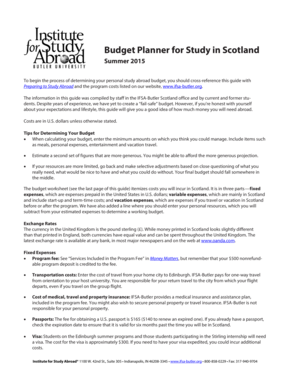

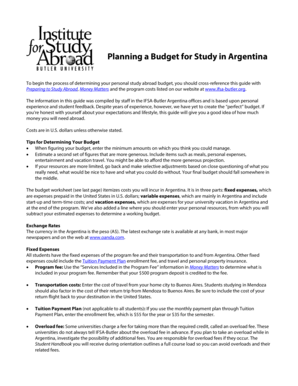

Printable Weekly Budget Planner: These are downloadable templates that can be printed and filled out manually.

Spreadsheet Weekly Budget Planner: These are budget planners created on spreadsheet software like Excel, allowing for easy calculations and customization.

Online Weekly Budget Planner: These are web-based tools or apps that can be accessed from any device with an internet connection, allowing users to input and track their expenses online.

Mobile Weekly Budget Planner: These are mobile applications designed specifically for budget planning and expense tracking on smartphones and tablets.

Custom Weekly Budget Planner: These are personalized budget planners created using software or online tools, with the ability to include specific categories and features tailored to an individual's or business's needs.

How to complete Weekly Budget Planner

Completing a Weekly Budget Planner is a simple process that can help you gain control over your finances. Here are the steps to complete a Weekly Budget Planner:

01

Set your financial goals: Determine what you want to achieve with your budget, whether it's saving for a specific expense or reducing debt.

02

Track your income: List all your sources of income for the week, including salaries, freelance work, and any other forms of income.

03

Identify your expenses: Make a comprehensive list of all your expenses for the week, categorizing them into fixed expenses (such as rent or mortgage) and variable expenses (such as groceries or entertainment).

04

Allocate funds: Assign a budgeted amount for each category of expenses based on your income and financial goals.

05

Monitor your spending: Regularly track your actual expenses against your budgeted amounts to identify any discrepancies or areas where you need to adjust.

06

Make adjustments: If you find that you are consistently overspending in certain areas, adjust your budget accordingly to align with your financial goals.

07

Review and analyze: At the end of the week, review your budget planner and analyze your financial progress. Use this information to make informed decisions for the next week's budget.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Weekly Budget Planner

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a budget template in Word?

0:00 1:02 How to Create a Budget in Microsoft Word 2010 - YouTube YouTube Start of suggested clip End of suggested clip And then you're going to select new on the right side of the screen you'll notice that there areMoreAnd then you're going to select new on the right side of the screen you'll notice that there are budgets. In terms of templates under office comm. So you click on budgets.

How do I make a weekly budget plan?

Creating a weekly budget How much do you earn? How much are you spending? Split your outgoings into mandatory and lifestyle. Remove your outgoings from your income, and look for ways to cut spending. Think about the future. Choose goals you can meet. Schedule monthly check-ins.

How do I create a budget planner?

How to Make a Budget Plan: 6 Easy Steps Select your budget template or application. Collect all your financial paperwork or electronic bill information. Calculate your monthly income. Establish a list of your monthly expenses. Categorize your expenses and designate spending values. Adjust your budget accordingly.

How do I create a weekly budget in Excel?

How to Make a Budget in Excel from Scratch Step 1: Open a Blank Workbook. Step 2: Set Up Your Income Tab. Step 3: Add Formulas to Automate. Step 4: Add Your Expenses. Step 5: Add More Sections. Step 6.0: The Final Balance. Step 6.1: Totaling Numbers from Other Sheets. Step 7: Insert a Graph (Optional)

How do I create a weekly budget template?

How to create a weekly budget template you will use. Divide expenses into discretionary and non-discretionary. There are two types of expenses: those you must pay and those you choose to pay. Add a contingency. Organize and update your weekly budget regularly.

What should a weekly budget include?

25 Things to Include in Your Budget Rent. Food and Groceries. Daily Incidentals. Irregular Expenses and Emergency Fund. Household Maintenance. Work Wardrobe and Upkeep. Subscriptions. Guests.