What is dave ramsey allocated spending plan?

Dave Ramsey Allocated Spending Plan, also known as the Zero-Based Budget, is a personal budgeting method created by finance expert Dave Ramsey. It is designed to help individuals take control of their finances by assigning every dollar of their income to a specific category. By allocating money to essential expenses, savings, and debt payments, individuals can achieve financial goals and eliminate debt.

What are the types of dave ramsey allocated spending plan?

There are various types of Dave Ramsey Allocated Spending Plans that individuals can choose based on their financial situation. These include:

Basic Allocated Spending Plan: This plan focuses on essential expenses like housing, transportation, food, and utilities.

Advanced Allocated Spending Plan: This plan includes additional categories such as debt payments, savings, investments, and entertainment.

Custom Allocated Spending Plan: This plan allows individuals to create their own categories based on their unique needs and priorities.

How to complete dave ramsey allocated spending plan

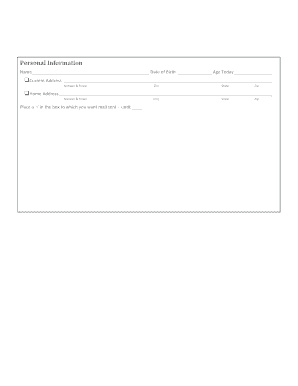

Completing a Dave Ramsey Allocated Spending Plan is a straightforward process that provides a clear roadmap for managing your finances. Here are the steps to follow:

01

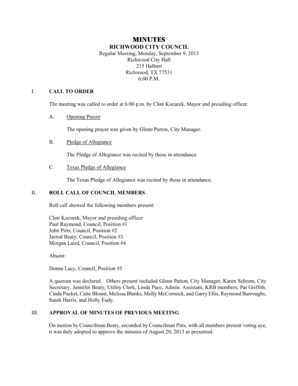

Calculate your Total Monthly Income: Add up all your sources of income to determine the total amount available for budgeting.

02

Identify Essential Expenses: List all necessary expenses, such as rent/mortgage, utilities, groceries, transportation, and insurance.

03

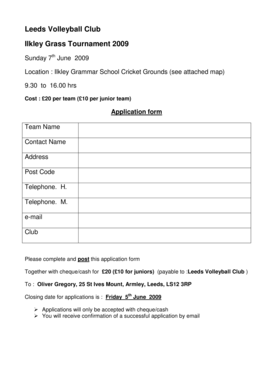

Allocate Money to Each Category: Assign a specific amount to each expense category based on your income and priorities.

04

Set Aside Money for Savings and Debt Payments: Allocate a portion of your income towards savings and debt repayment.

05

Track and Adjust: Regularly monitor your spending and make adjustments as needed to stay within your budget.

06

Use pdfFiller for Easy Budgeting: Empower yourself with pdfFiller's online platform to create, edit, and share your budgeting documents conveniently. With unlimited fillable templates and powerful editing tools, pdfFiller is your all-in-one solution for effective budget management.

Take control of your finances today by implementing a Dave Ramsey Allocated Spending Plan. With proper budgeting and the right tools like pdfFiller, you can achieve financial stability and reach your goals.