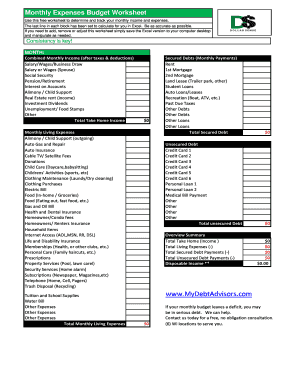

What is budget worksheet excel?

A budget worksheet excel is a tool used to track and manage personal or business finances. It is a spreadsheet formatted in Excel that allows users to input their income, expenses, and savings goals. By organizing financial information in one place, budget worksheet excel helps users gain a clear understanding of their financial situation and make informed financial decisions.

What are the types of budget worksheet excel?

There are various types of budget worksheet excel available to cater to different financial needs. Some common types include:

Personal budget worksheet excel: Designed for individuals to track their personal finances, including income, expenses, savings, and debt payments.

Business budget worksheet excel: Specifically created for business owners to monitor their company's finances, including revenue, expenses, and profit margins.

Event budget worksheet excel: Used to plan and track expenses for specific events, such as weddings, parties, or conferences.

Project budget worksheet excel: Helps manage the budget for a specific project, tracking costs, resources, and deadlines.

Monthly or yearly budget worksheet excel: Provides an overview of income and expenses for a given period, aiding in long-term financial planning.

How to complete budget worksheet excel

Completing a budget worksheet excel can seem overwhelming at first, but with the right approach, it becomes a helpful tool for managing finances. Here are the steps to complete a budget worksheet excel:

01

Start by gathering all necessary financial documents, such as pay stubs, bank statements, bills, and receipts.

02

Open the budget worksheet excel template or create a new one using a blank spreadsheet.

03

Input your income sources, including wages, investments, and other sources of revenue.

04

List your fixed expenses, such as rent/mortgage payments, utilities, and insurance.

05

Record variable expenses like groceries, entertainment, and transportation.

06

Calculate your total income and total expenses to determine your net income.

07

Set financial goals, such as saving a certain percentage of your income or paying off debt.

08

Adjust your budget as necessary to align with your goals and financial priorities.

09

Regularly update and review your budget to track your progress and make adjustments when needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.