Monthly Budgeting Worksheets

What is monthly budgeting worksheets?

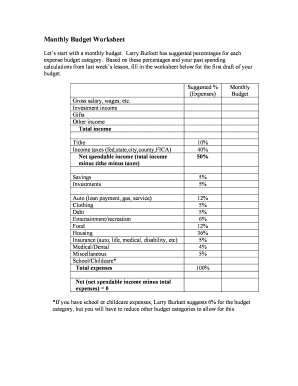

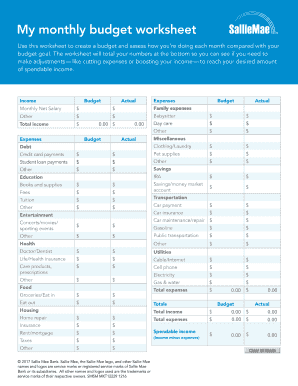

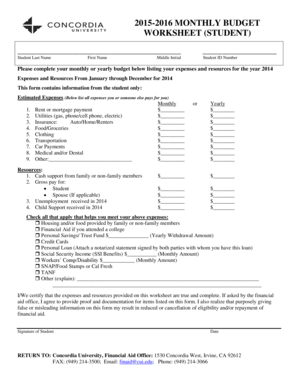

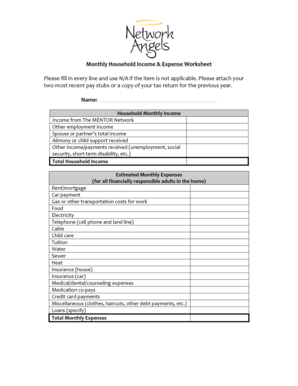

Monthly budgeting worksheets are tools that help individuals or households track and manage their finances on a monthly basis. These worksheets typically include sections for income, expenses, savings, and debt payments. By using these worksheets, users can create a clear picture of their financial situation, identify areas where they can cut back on expenses, and set realistic goals for saving and debt repayment.

What are the types of monthly budgeting worksheets?

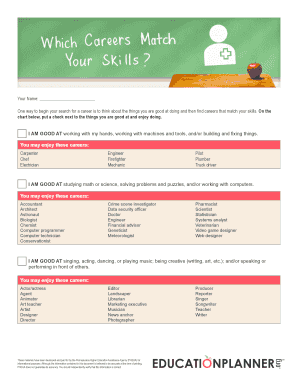

There are various types of monthly budgeting worksheets available, depending on specific needs and preferences. Some common types include: 1. Basic Budget Worksheet: This type includes sections for income, expenses, savings, and debt payments. 2. Detailed Expense Tracker: This type breaks down expenses into categories such as groceries, utilities, transportation, entertainment, etc. 3. Cash Flow Statement: This type focuses on tracking the inflow and outflow of cash, helping users understand their cash flow and make informed financial decisions. 4. Bill Payment Tracker: This type specifically helps users keep track of their bill payments, ensuring they never miss a due date.

How to complete monthly budgeting worksheets

Completing monthly budgeting worksheets is a straightforward process. Here are the steps to follow: 1. Gather all necessary financial information: This includes income statements, bank statements, bills, and receipts. 2. Start with the income section: Record all sources of income, such as salary, dividends, or freelance earnings. 3. Move on to the expenses section: List all regular expenses, such as rent/mortgage, utilities, groceries, transportation, etc. 4. Track variable expenses: Take note of any expenses that fluctuate each month, such as dining out or entertainment. 5. Calculate savings and debt payments: Determine how much you can allocate towards savings and debt repayment each month. 6. Review and adjust: Periodically review your budgeting worksheet to ensure it accurately reflects your financial situation and make any necessary adjustments.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.