What Is A 1098 Form

What is a 1098 form?

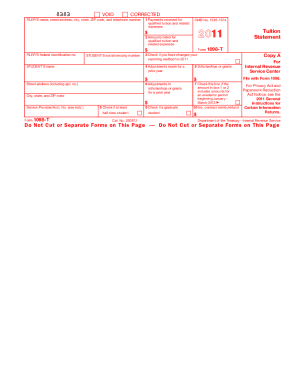

A 1098 form is an IRS tax form that is used to report certain types of payments. It is specifically used to report mortgage interest, student loan interest, and tuition payments. The purpose of this form is to provide the recipient with the information they need to determine if they are eligible for any deductions or credits on their tax return.

What are the types of 1098 forms?

There are several types of 1098 forms. The most common ones include: 1. Form 1098 Mortgage Interest: This form is used by homeowners to report the amount of mortgage interest they paid throughout the year. 2. Form 1098-E Student Loan Interest: This form is used by individuals who paid interest on qualified student loans. 3. Form 1098-T Tuition Statement: This form is used by educational institutions to report tuition payments and any scholarships or grants received by the student.

How to complete a 1098 form?

Completing a 1098 form may seem daunting, but with the right information, it can be done easily. Here are the steps to follow: 1. Gather the necessary information: Collect all the relevant information, such as the recipient's name, address, and taxpayer identification number (TIN). 2. Fill in the form: Enter the accurate amounts of the payments made in the appropriate sections of the form. 3. Review the information: Double-check all the details to ensure accuracy and completeness. 4. Submit the form: Send the completed form to the recipient and file a copy with the IRS.

pdfFiller is an online platform that empowers users to create, edit, and share documents seamlessly. With unlimited fillable templates and powerful editing tools, pdfFiller is the one-stop solution for all your PDF editing needs.