Where To Get Hud 1 Statement

What is where to get hud 1 statement?

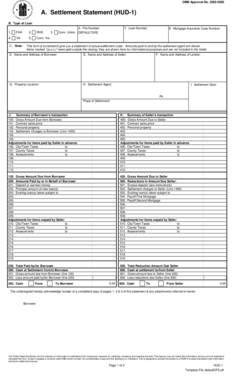

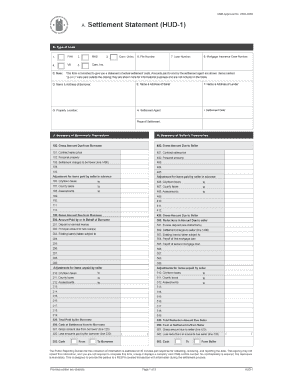

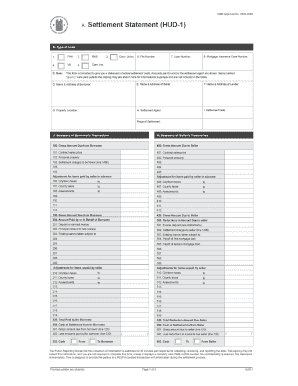

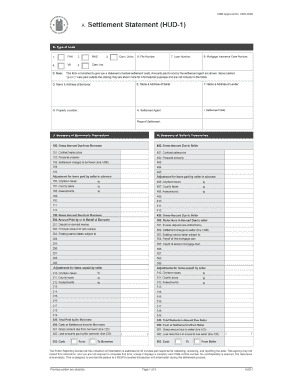

When it comes to obtaining a HUD-1 statement, it is important to know where to find it. The HUD-1 statement, also known as the Closing Disclosure, is a document provided by the US Department of Housing and Urban Development (HUD). It is a standardized form that details the financial aspects of a real estate transaction, including the loan terms, closing costs, and other important information. To get a HUD-1 statement, you can visit the HUD website, contact your lender or closing agent, or consult a real estate professional who can guide you through the process.

What are the types of where to get hud 1 statement?

There are two main types of HUD-1 statements that you can obtain. The first one is the initial HUD-1 statement, which is typically provided to the borrower before closing on a property. This document gives you a detailed breakdown of the estimated closing costs and other financial obligations associated with the transaction. The second type is the final HUD-1 statement, which is provided at the closing of the real estate transaction. It reflects the actual costs incurred and any adjustments made during the closing process. Both types of HUD-1 statements are crucial in understanding and managing the financial aspects of a real estate transaction.

How to complete where to get hud 1 statement

Completing a HUD-1 statement requires attention to detail and accurate information. Here is a step-by-step guide to help you complete this important document:

With pdfFiller, completing a HUD-1 statement has never been easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Whether you need to fill out a HUD-1 statement or any other important document, pdfFiller provides a seamless and user-friendly experience.