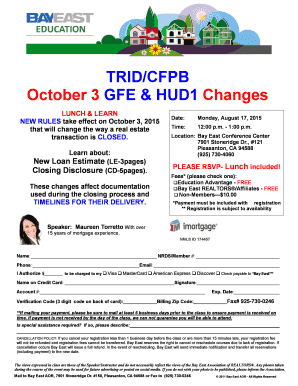

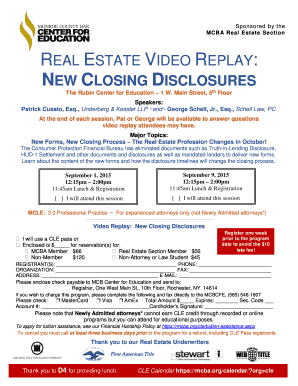

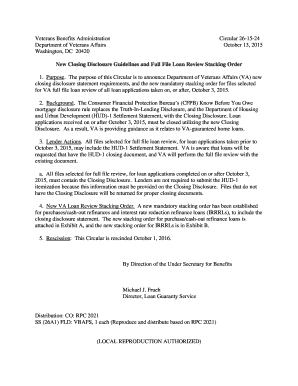

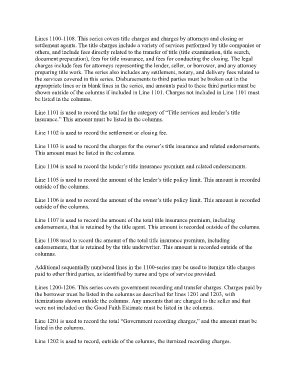

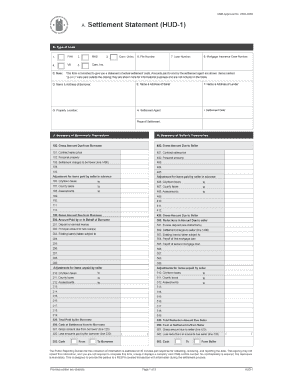

Hud-1 Closing Disclosure

What is hud-1 closing disclosure?

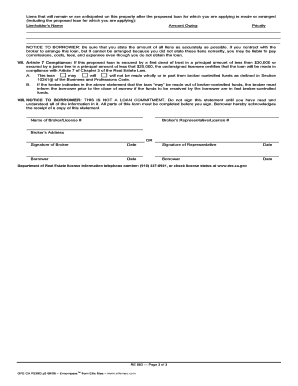

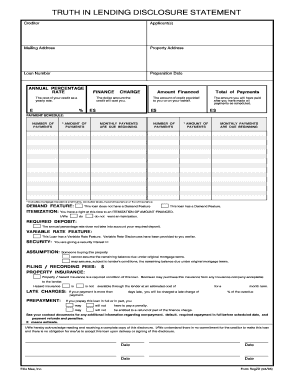

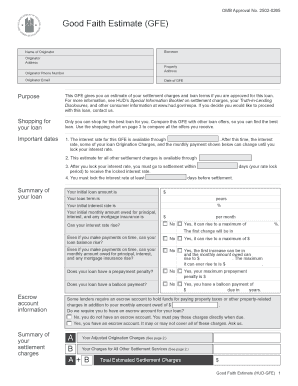

The hud-1 closing disclosure is a document used in real estate transactions to detail all the charges and fees associated with the closing of a mortgage loan. It provides a summary of the buyer's and seller's financial transactions, including the loan terms, closing costs, and any adjustments made during the settlement.

What are the types of hud-1 closing disclosure?

There are two types of hud-1 closing disclosure: the borrower's copy and the seller's copy. The borrower's copy is given to the buyer, while the seller's copy is provided to the seller. Both copies contain similar information but are tailored to the respective party's needs.

How to complete hud-1 closing disclosure

Completing the hud-1 closing disclosure involves several steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.