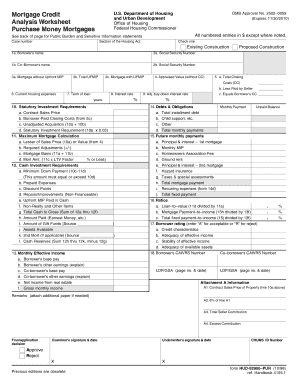

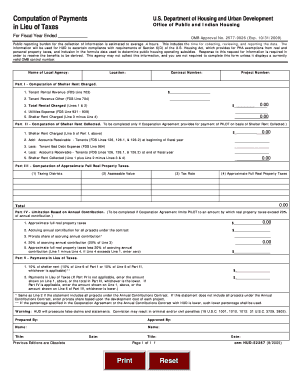

Hud 1 Template

What is Hud 1 Template?

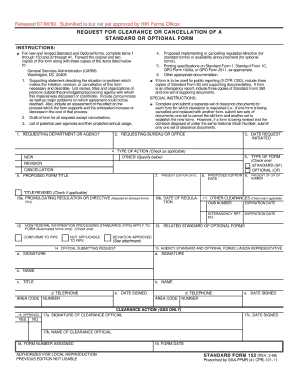

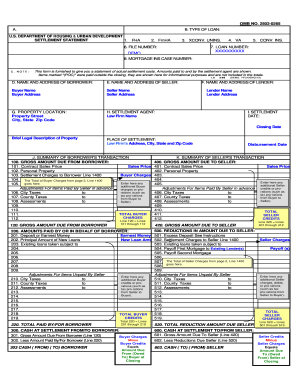

Hud 1 Template is a standardized form used in real estate transactions in the United States. It is also known as the Settlement Statement and is required by the Department of Housing and Urban Development (HUD) for all transactions involving federally regulated mortgage loans. The form provides a detailed breakdown of the costs and fees associated with the transaction, including the loan terms, closing costs, and other relevant financial information.

What are the types of Hud 1 Template?

There are two main types of Hud 1 Templates. The first type is used for purchases of residential properties, where the buyer is obtaining financing through a mortgage loan. The second type is used for refinancing transactions, where the borrower is replacing an existing loan with a new one. Both types of Hud 1 Templates serve the same purpose of disclosing the financial aspects of the transaction, but they have slight differences in terms of the information included.

How to complete Hud 1 Template

Completing a Hud 1 Template requires careful attention to detail and accurate information. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.