Last updated on

Sep 20, 2025

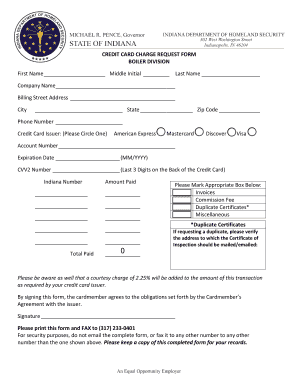

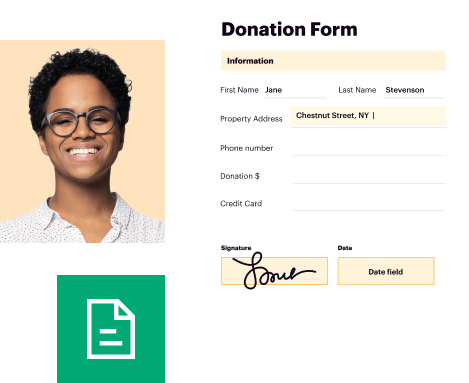

Customize and complete your essential Notice To Stop Credit Charge template

Prepare to streamline document creation using our fillable Notice To Stop Credit Charge template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

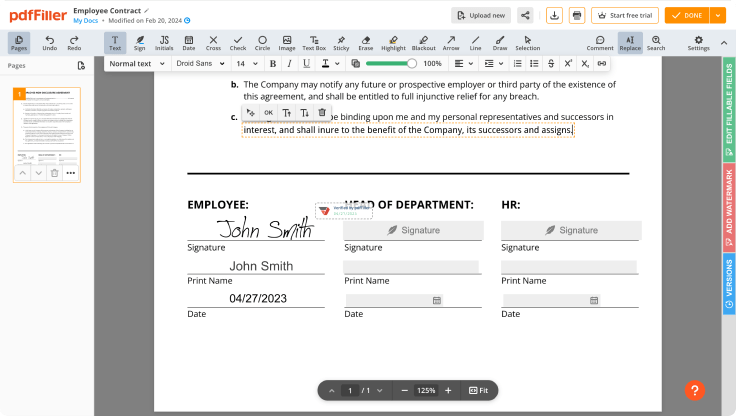

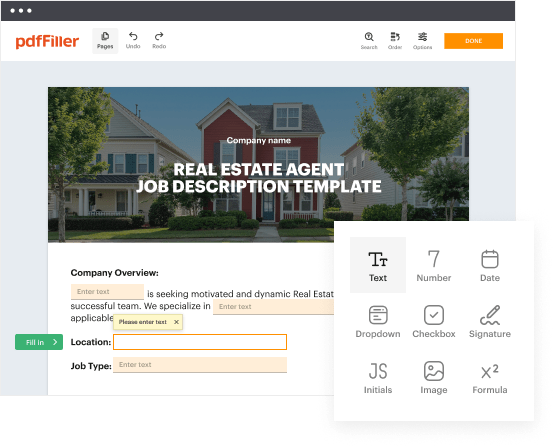

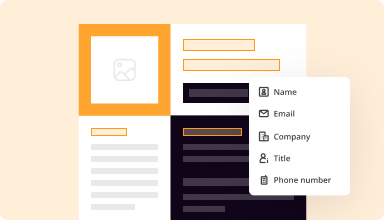

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

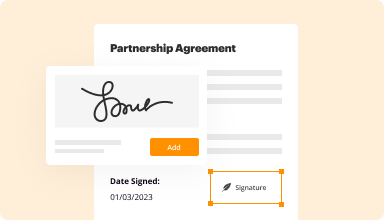

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

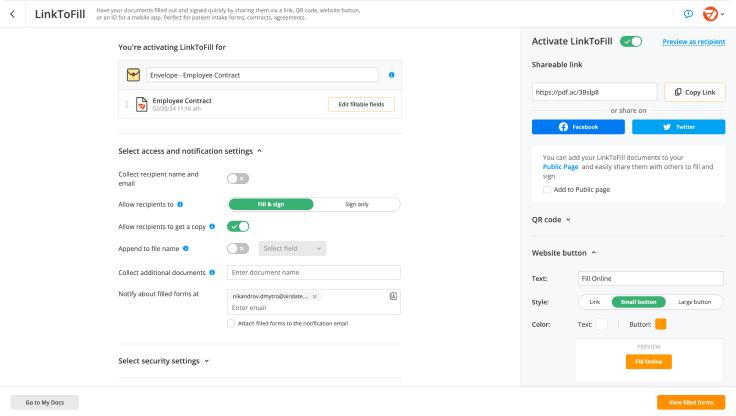

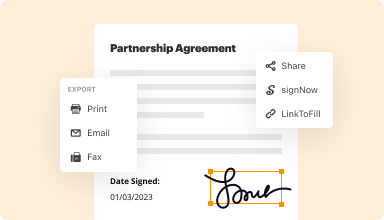

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

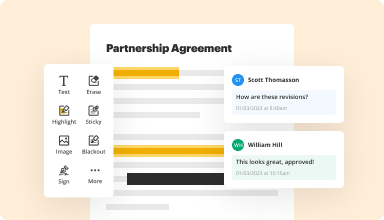

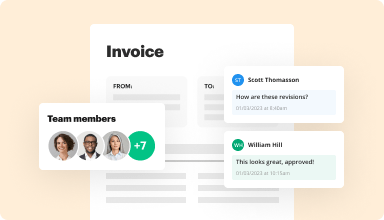

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Notice To Stop Credit Charge Template

Are you looking for a straightforward way to manage unwanted credit charges? Our customizable Notice To Stop Credit Charge template offers a reliable solution. With this template, you can effectively communicate your intentions to cease unauthorized credit transactions, ensuring clarity and consistency in your financial dealings.

Key Features

User-friendly design that is easy to customize

Option to include specific charge details

Clear instructions for delivery methods

Template saves time and reduces stress

Appropriate for various financial situations

Potential Use Cases and Benefits

Individuals disputing unauthorized fees

Small business owners managing vendor charges

Consumers seeking to halt recurring payments

Anyone needing to formalize their request in writing

Users aiming to maintain organized financial records

By utilizing our Notice To Stop Credit Charge template, you address financial discrepancies directly and effectively. This tool empowers you to take control of your finances, minimize misunderstandings, and protect your rights as a consumer. Save time and effort while clearly stating your needs, allowing you to focus more on what matters.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Notice To Stop Credit Charge

Creating a Notice To Stop Credit Charge has never been simpler with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller offers an intuitive platform to build, customize, and manage your documents effectively. Employ our versatile and fillable web templates that line up with your specific needs.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to effortlessly create accurate documents with a simple click. your journey by following our detailed instructions.

How to create and complete your Notice To Stop Credit Charge:

01

Sign in to your account. Access pdfFiller by signing in to your account.

02

Find your template. Browse our comprehensive library of document templates.

03

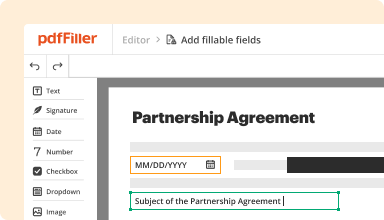

Open the PDF editor. Once you have the form you need, open it up in the editor and utilize the editing tools at the top of the screen or on the left-hand sidebar.

04

Add fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight areas, add images, and make any needed modifications. The intuitive interface ensures the process remains smooth.

06

Save your edits. When you are satisfied with your edits, click the “Done” button to save them.

07

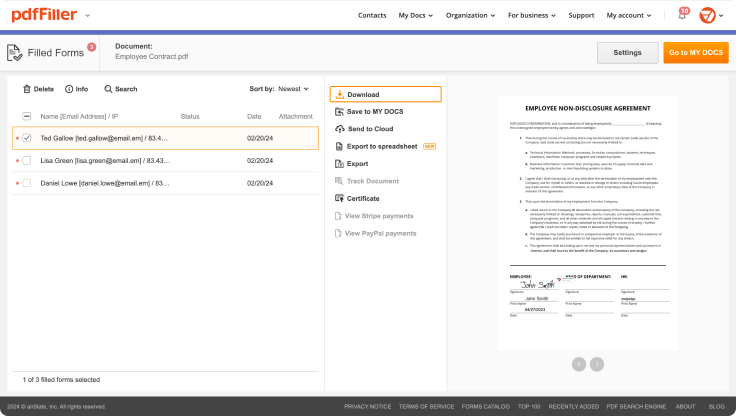

Submit or store your document. You can send it to others to eSign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a smooth process that saves you time and ensures accuracy. Start using pdfFiller right now to benefit from its powerful features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How long does a charge-off stay on credit?

How long will the charge-off stay on credit reports? Similar to late payments and other information on your credit reports that's considered negative, a charged-off account will remain on credit reports up to seven years from the date of the first missed or late payment on the charged-off account.

How do I stop a credit charge?

Contact your credit card issuer You can only dispute charges that have already been posted. If you prefer not to submit a dispute online, you may do so in writing, or by calling customer service and disputing the charge over the phone.

How can I block a company from charging my credit card?

Stopping a card payment You can tell the card issuer by phone, email or letter. Your card issuer has no right to insist that you ask the company taking the payment first. They have to stop the payments if you ask them to. If you ask to stop a payment, the card issuer should investigate each case on its own merit.

How do I stop my account from being charged-off?

Avoiding a charged-off account is easier than you might think. All you have to do is make the minimum payment on your accounts each month. Each month you're late on a payment, you're one step closer to having your account charged-off.

Can you remove a charge-off from your credit report?

If your debt is still with the original lender, you can ask to pay the debt in full in exchange for the charge-off notation to be removed from your credit report. If your debt has been sold to a third party, you can still try a pay for delete agreement.

How do I settle a charge-off?

Borrowers hoping to achieve a settlement contact the lender, verify the amount owed, and attempt to negotiate an acceptable middle ground. Customarily, settlements are paid in a single lump-sum payment; however, borrowers may be able to score a reduced-payment plan.

How do I stop a charge-off on my credit report?

After you've paid off your debt, you can contact the original lender or collections agency and ask them to remove the charge-off from your credit report.

How do you write a notice to close a credit card account?

Follow up with a brief letter to your card issuer stating your desire to close the credit card. Include that you want the account to be “closed at consumer's request” and include your name, address, phone number, account number, and the details of your call with the bank's representative.

How do I write a letter to close my credit card account?

I am writing this letter to close my credit card account for the following reason: __ I haven't used the account for quite some time and don't plan to use it in the future. I'm not carrying a balance on this account. Thank you for closing my account promptly.

What is an example of a cancellation letter for a credit card?

Request to Cancel Credit Card I hereby request that you cancel the credit card(s) for the account number listed above. Use of the credit card(s) has been discontinued as of , and charges for transactions after that date will not be made. The card(s) for the above account have been destroyed.

How do I close a credit card account permanently?

In general, you should be able to close your account by calling the credit card company and following up with a written notice. If you still have a balance when you close your account, you are required to pay off any balance on schedule. The card company is allowed to charge interest on the amount you still owe.

How do I close my credit card and stop interest?

To close your credit card account, you'll need to pay the full outstanding balance including any accrued interest and fees. Known as a payout figure, this amount can change daily for a number of reasons, such as pending or recurring transactions, or accrued interest.

Can you stop charge on credit card?

Yes, you can block a company from charging your credit card. You do this by contacting your bank and either revoking authorization for the payment or requesting a stop payment order.

Can I cancel a credit charge?

To cancel a pending credit card transaction before it's complete, start by calling the merchant directly. Ask the merchant or retailer to reverse the charge, cancel the sale or release the hold for the confirmed amount.

Can I block a charge on my credit card?

Transactions already in process or completed can't be stopped. Once it's posted, you may be able to dispute the charge. See also: How do I dispute a transaction on my credit card? To stop a scheduled transaction, you'll need to submit the request at least three business days before the scheduled charge date.

How do I stop a credit card charge-off?

To avoid being caught off guard by a charge-off: Ensure your creditors have up-to-date contact information. Open and respond to any letters sent regarding a delinquent account. Contact your creditor if you cannot make the minimum payment to discuss ways to keep your account in good standing.

Can I tell my bank to block a transaction?

You can contact your bank and place a stop payment order on the recurring transaction. Generally, a stop payment order is only good for six months. To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing.

Can I block a company from taking money from my card?

Stopping a card payment To withdraw consent, simply tell whoever issued your card (the bank, building society or credit card company) that you don't want the payment to be made. You can tell the card issuer by phone, email or letter.

Can I block a subscription from charging my credit card?

To stop a scheduled transaction, you'll need to submit the request at least three business days before the scheduled charge date. Stopping a recurring charge doesn't change any agreements you have with the merchant. Reaching out to them can help avoid penalties or fees they may charge.

Can I block a specific company from charging my credit card?

Can I block a company from charging my card? Yes, you can block a company from charging your credit card. You do this by contacting your bank and either revoking authorization for the payment or requesting a stop payment order.