Free Merger And Acquisition Word Templates - Page 28

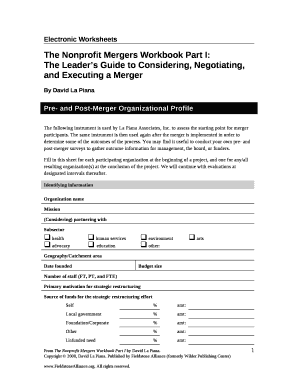

What are Merger And Acquisition Templates?

Merger and Acquisition Templates are pre-designed documents that outline the process and terms of a merger or acquisition between two companies. These templates help streamline the negotiation and documentation process by providing a framework for the agreement.

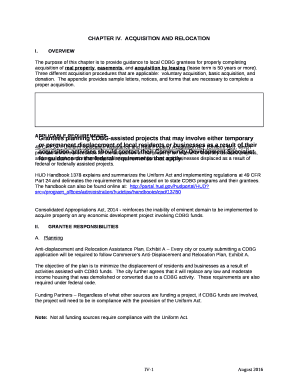

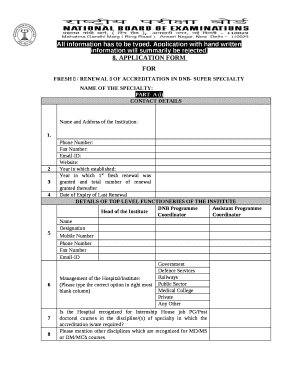

What are the types of Merger And Acquisition Templates?

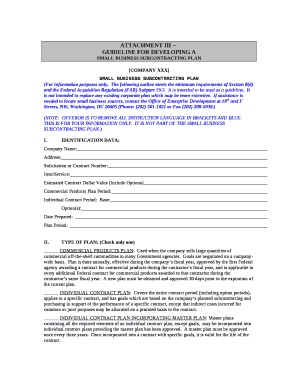

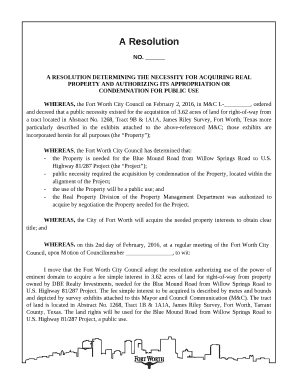

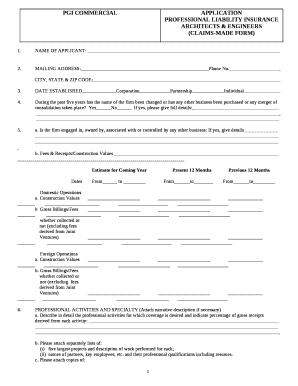

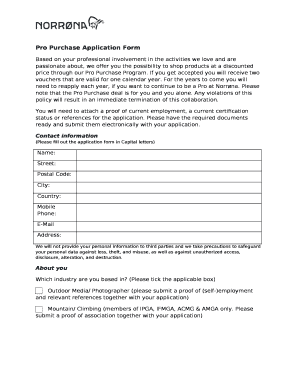

There are several types of Merger and Acquisition Templates available, including: Letter of Intent, Acquisition Agreement, Due Diligence Checklist, Merger Agreement, Non-Disclosure Agreement, and Transition Services Agreement.

How to complete Merger And Acquisition Templates

Completing Merger and Acquisition Templates can be a complex process, but with the right guidance, it can be simplified. Here are some steps to help you complete your Merger and Acquisition Templates:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.