Free Budget Estimate Word Templates - Page 2

What are Budget Estimate Templates?

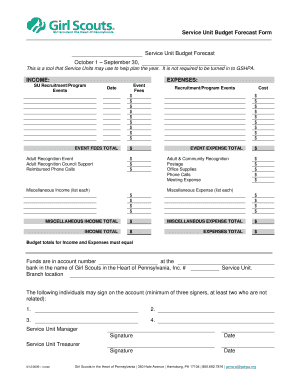

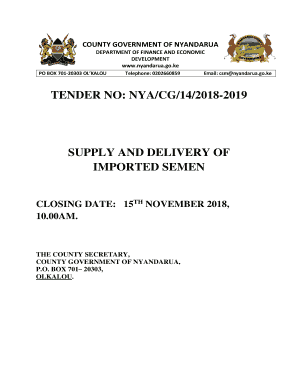

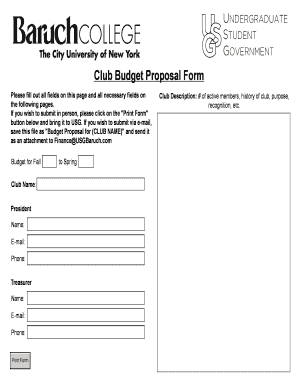

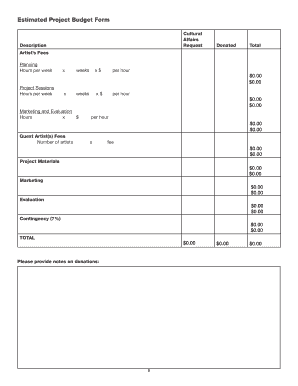

Budget Estimate Templates are pre-designed forms or spreadsheets that help users to outline and organize their financial plans for a specific project or time period. These templates provide a structured framework for users to input their income, expenses, and allocate funds accordingly.

What are the types of Budget Estimate Templates?

Budget Estimate Templates come in various types based on the specific needs of the user. Some common types include:

How to complete Budget Estimate Templates

Completing a Budget Estimate Template is a straightforward process that can help you stay organized and track your finances effectively. Here are some steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.