Free Finance Flowchart Word Templates - Page 4

What are Finance Flowchart Templates?

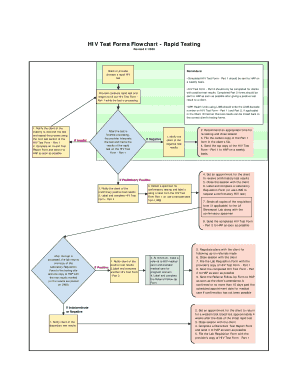

Finance Flowchart Templates are visual representations of various financial processes and workflows. They help users to easily understand and navigate complex financial information by breaking it down into easily digestible diagrams.

What are the types of Finance Flowchart Templates?

There are several types of Finance Flowchart Templates available, including: Income Statement Flowcharts, Cash Flow Diagrams, Budget Planning Charts, Investment Decision Trees, and Financial Reporting Graphs.

Income Statement Flowcharts

Cash Flow Diagrams

Budget Planning Charts

Investment Decision Trees

Financial Reporting Graphs

How to complete Finance Flowchart Templates

To successfully complete Finance Flowchart Templates, follow these steps:

01

Understand the financial process you are trying to represent in the flowchart

02

Gather all necessary data and information

03

Use appropriate symbols and colors to represent different elements in the flowchart

04

Review and refine the flowchart for accuracy and clarity

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Finance Flowchart Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Which is the correct order of the procedure of financial planning?

Preparation of a sales forecast, Preparation of financial statements, Estimation of expected profit is the correct sequence of the financial planning process.

What are the 5 steps in personal finance?

Financial Planning Process 1) Identify your Financial Situation. 2) Determine Financial Goals. 3) Identify Alternatives for Investment. 4) Evaluate Alternatives. 5) Put Together a Financial Plan and Implement. 6) Review, Re-evaluate and Monitor The Plan.

What are the 7 steps in the financial planning process?

Financial Planning Steps – From Start To Finish Find An Experienced Certified Financial Planner™ Professional. Determine Your Present Financial Situation. Develop Financial Goals. Identify Alternative Courses of Action. Evaluate Alternatives. Create and Implement Financial Plans of Action. Reevaluate (and Revise) your Plan.

What is the order of the financial steps?

Fortunately, getting your finances in order is not a difficult task, especially if you follow these 10 steps. Make a commitment. Order a credit report. Gather financial paperwork. Organize financial documents. Analyze your insurance coverage. Make a will. Create a budget and stick to it. Reduce your debt.

What are the 4 basics of financial planning?

The main elements of a financial plan include a retirement strategy, a risk management plan, a long-term investment plan, a tax reduction strategy, and an estate plan.

What is a financial flowchart?

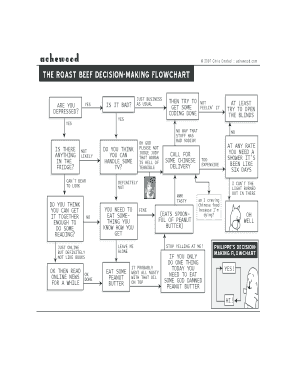

Personal finance flowcharts can be a helpful way to keep track of your bills and finances. By starting with your income and then tracking where your money goes, you can create a budget and see where you may be able to save money.