Free Insurance Plan Word Templates - Page 3

What are Insurance Plan Templates?

Insurance plan templates are pre-designed documents that outline the structure and details of various insurance plans. They serve as a starting point for individuals and businesses to create personalized insurance policies tailored to their specific needs and requirements.

What are the types of Insurance Plan Templates?

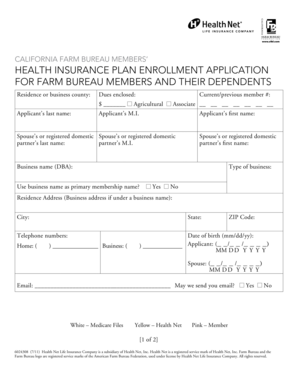

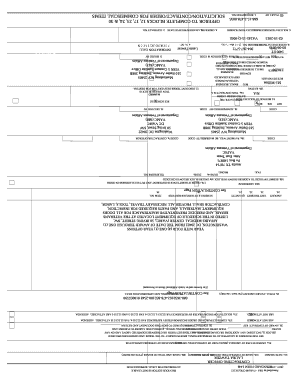

There are several types of insurance plan templates available for different purposes, including: health insurance templates, life insurance templates, auto insurance templates, home insurance templates, and business insurance templates.

How to complete Insurance Plan Templates

Completing insurance plan templates is a simple process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.