Free Professional Banking Resume Word Templates

What are Professional Banking Resume Templates?

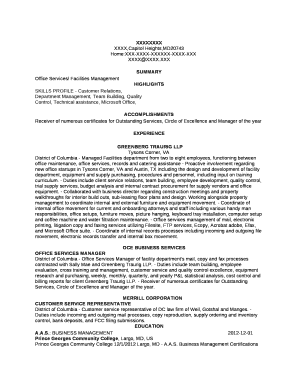

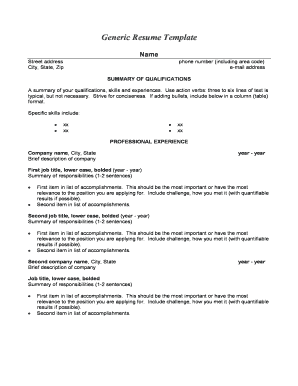

Professional Banking Resume Templates are pre-designed formats that individuals in the banking industry can use to showcase their skills, experience, and qualifications in a visually appealing manner. These templates help job seekers make a strong impression on potential employers and stand out from the competition.

What are the types of Professional Banking Resume Templates?

There are several types of Professional Banking Resume Templates available to job seekers, including: 1. Entry-level Banking Resume Templates 2. Experienced Banking Professional Resume Templates 3. Financial Analyst Resume Templates 4. Branch Manager Resume Templates 5. Investment Banking Resume Templates

How to complete Professional Banking Resume Templates

Completing Professional Banking Resume Templates is a straightforward process that involves the following steps: 1. Choose a template that best fits your experience and career level. 2. Fill in your contact information, including your name, phone number, and email address. 3. List your work experience in the banking industry, including relevant job titles, responsibilities, and achievements. 4. Highlight your education background, certifications, and any specialized training. 5. Tailor your resume to the specific job you are applying for by emphasizing relevant skills and experiences.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.