Free Payment Schedule Word Templates

What are Payment Schedule Templates?

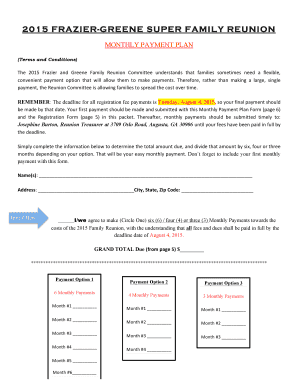

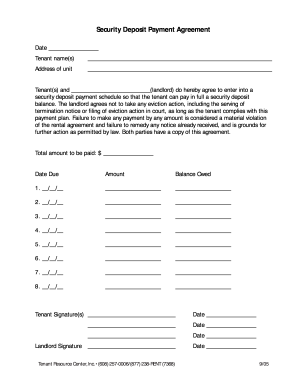

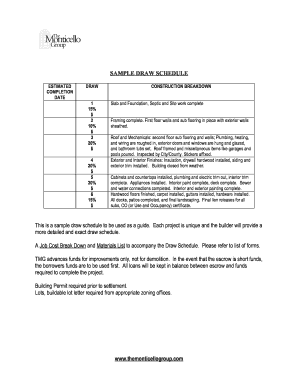

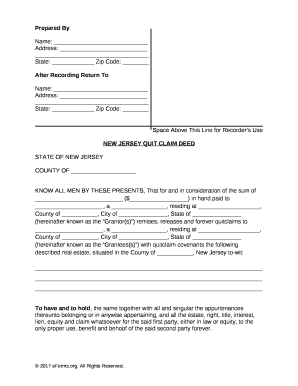

Payment schedule templates are predefined documents that outline the agreed-upon payment terms between parties. These templates help to ensure clarity and consistency in payments, reducing misunderstandings and disputes.

What are the types of Payment Schedule Templates?

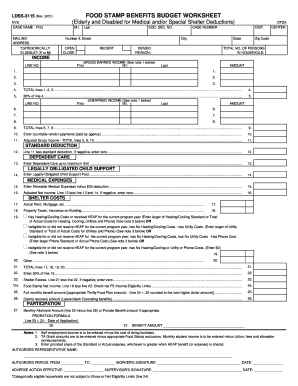

There are several types of payment schedule templates, including:

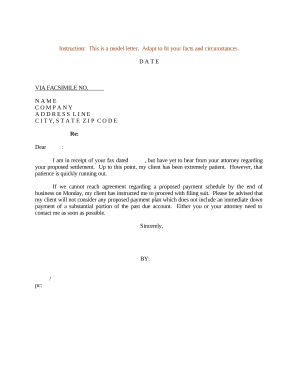

Standard Payment Schedule Template

Milestone Payment Schedule Template

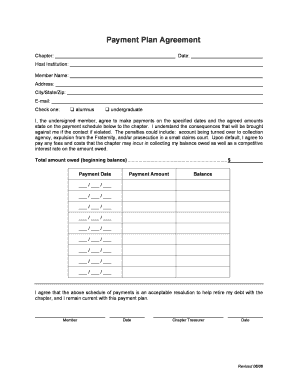

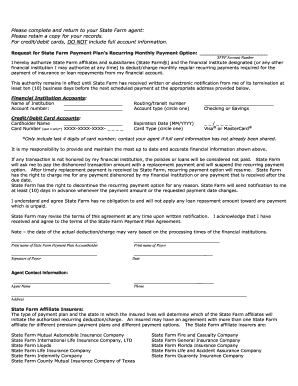

Recurring Payment Schedule Template

Custom Payment Schedule Template

How to complete Payment Schedule Templates

Completing payment schedule templates is a simple process that involves:

01

Fill in the details of the parties involved in the payment agreement

02

Specify the payment terms, including amounts, due dates, and payment methods

03

Review the completed template for accuracy and clarity before finalizing it

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payment Schedule Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you calculate payment schedule?

Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal.

What are the types of loan payment schedule?

Loan Repayment Plans Standard Repayment. Under this plan you will pay a fixed monthly amount for a loan term of up to 10 years. Extended Repayment. Graduated Repayment. Income-Contingent Repayment. Income-Sensitive Repayment. Income-Based Repayment.

What are the monthly payments?

The monthly payment is the amount paid per month to pay off the loan in the time period of the loan. When a loan is taken out it isn't only the principal amount, or the original amount loaned out, that needs to be repaid, but also the interest that accumulates.

What is amortization schedule?

An amortization schedule, often called an amortization table, spells out exactly what you'll be paying each month for your mortgage. The table will show your monthly payment and how much of it will go toward paying down your loan's principal balance and how much will be used on interest.

What is scheduled monthly payment?

Scheduled Monthly Payments means minimum sums required to be paid with respect to all of the borrower's debts that are reported on a nationally recognized consumer credit bureau report and the monthly mortgage payment due under the high cost home loan (ignor- ing any reduction arising from a lower introductory rate)

Why do we have payment schedules?

A payment schedule allows both the buyer and the seller to set reasonable expectations for payments on goods and services that are delivered as part of the transaction. Defining the payment frequency is also an essential component of any payment schedule.