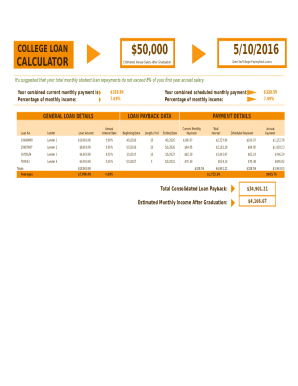

What is College Loan Calculator?

College Loan Calculator is a useful tool that helps students and their families estimate the costs associated with borrowing money for college. It takes into account factors such as interest rates, loan amounts, and repayment terms to provide an accurate picture of what a loan will cost over time. By using a College Loan Calculator, users can make informed decisions about their financial future when it comes to funding their education.

What are the types of College Loan Calculator?

There are several types of College Loan Calculators available to users, each with its unique features and benefits. Some common types include:

How to complete College Loan Calculator

Completing a College Loan Calculator is a simple process that can be broken down into a few easy steps. Follow these guidelines to get an accurate estimate of your college loan costs:

Remember, using a College Loan Calculator is a proactive step towards managing your finances responsibly and planning for a successful future. With tools like pdfFiller, you can create, edit, and share important documents online with ease, ensuring that your financial paperwork is always in order.