Copy Electronically Signing Tax Sharing Agreement with pdfFiller

To copy electronically signing a tax sharing agreement using pdfFiller, first, upload or select your existing document. Next, add digital signatures from all required parties. Finally, save and share the signed agreement with collaborators, ensuring legal compliance.

What is copying electronically signing a tax sharing agreement?

Copying electronically signing a tax sharing agreement refers to the process of creating a digital version of this important document and including electronic signatures from the involved parties. This method streamlines the workflow, enabling quick and secure US tax-sharing agreements.

Why does electronically signing tax sharing agreements matter for digital document workflows?

Opting for electronically signing tax sharing agreements enhances efficiency, accuracy, and security. It minimizes the time spent on document back-and-forth through physical signatures or mailing, therefore expediting transactions and confirming compliance with evolving tax regulations.

Use-cases and industries that frequently copy electronically signing tax sharing agreements

Various industries, including finance, accounting, and legal services, commonly utilize electronically signed tax sharing agreements. Professionals in these sectors leverage this method to ensure accurate tax records and uphold inter-party agreements regarding tax allocations.

-

Accounting firms establishing tax-sharing frameworks for clients.

-

Companies needing to comply with tax regulations across jurisdictions.

-

Partnerships defining profit-sharing and tax liabilities.

Step-by-step: how to copy electronically signing a tax sharing agreement in pdfFiller

Follow these steps to copy electronically signing a tax sharing agreement in pdfFiller:

-

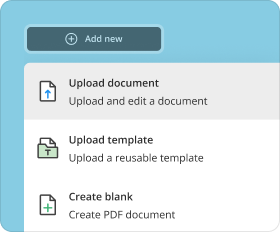

Log in to pdfFiller and upload your tax sharing agreement.

-

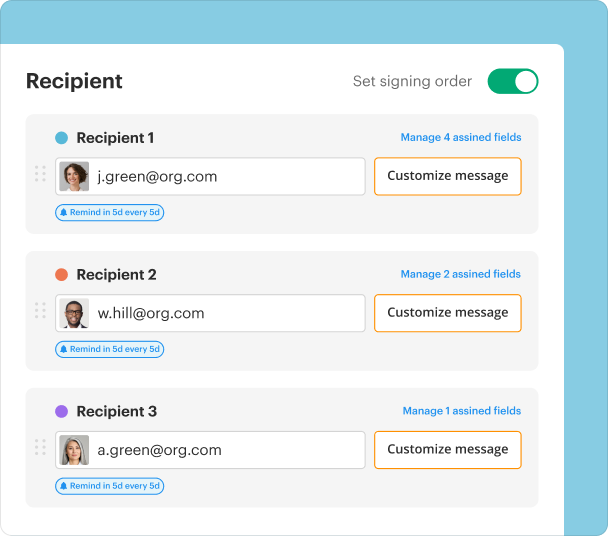

Choose the 'eSign' option to add digital signatures.

-

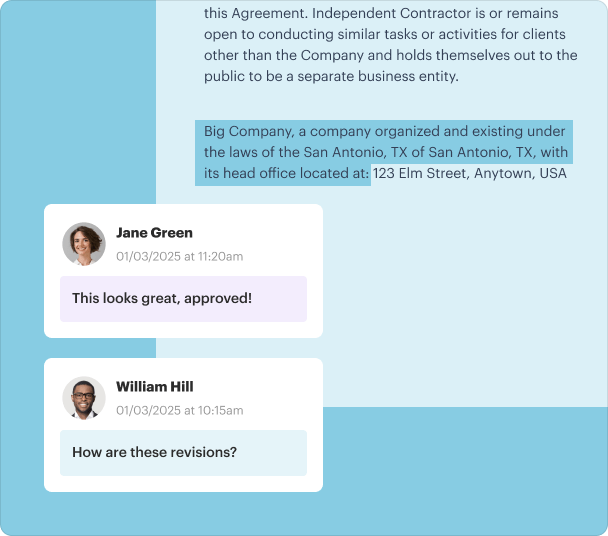

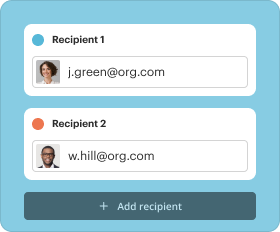

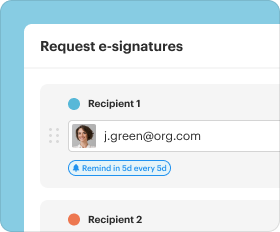

Specify signers by entering their email addresses.

-

Select or draw signature options for agreement approval.

-

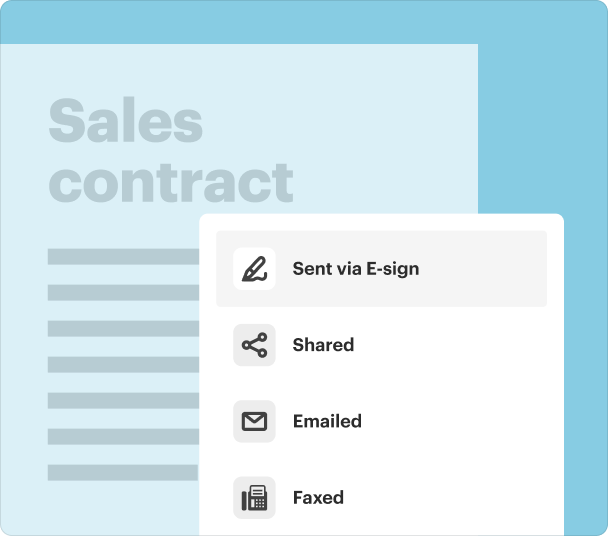

Review, finalize, and download the signed agreement.

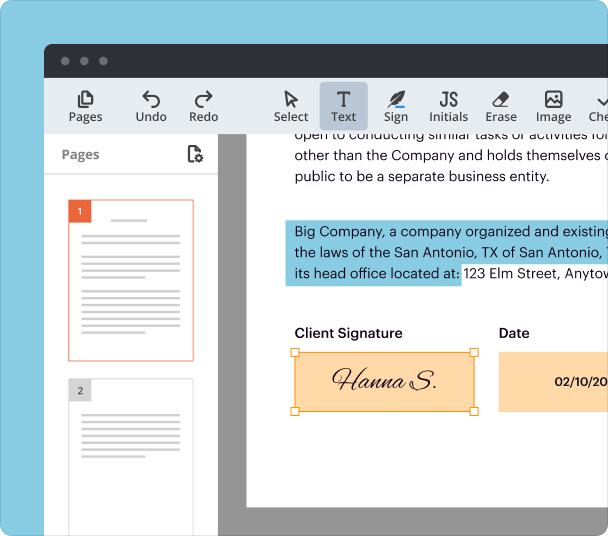

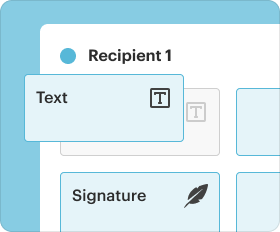

Options for customizing signatures, initials, and stamps when you copy electronically signing a tax sharing agreement

pdfFiller allows you to customize signatures, initials, and stamps within your documents. Users can choose from various pre-defined signature styles, or create their own unique signatures, ensuring the agreement reflects the identity of each signer.

Managing and storing documents after you copy electronically signing a tax sharing agreement

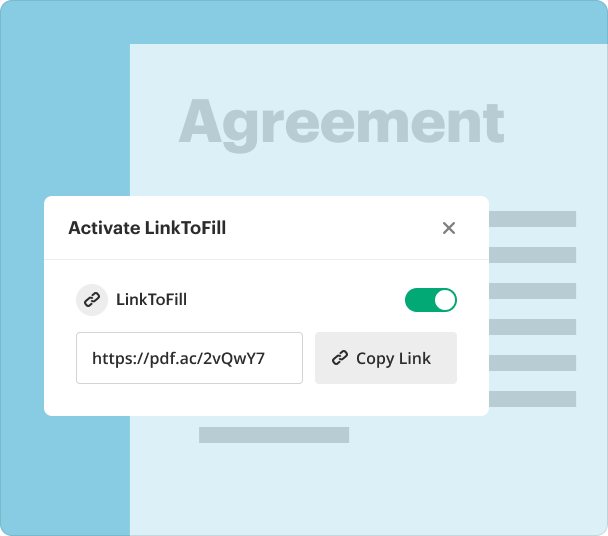

Once you've completed the electronically signing process, pdfFiller provides secure cloud storage for easy document management. You can organize your signed agreements, make annotations, and share them with stakeholders as needed, all from one platform.

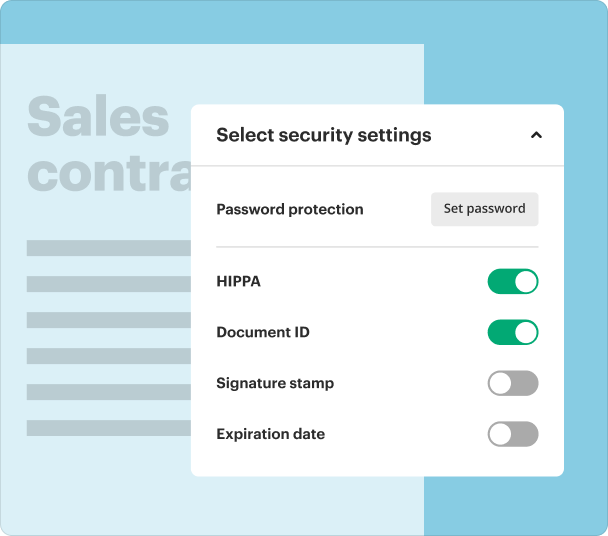

Security, compliance, and legal aspects when you copy electronically signing a tax sharing agreement

Electronic signatures have legal standing in many jurisdictions, including the United States. Using pdfFiller, your signed documents benefit from advanced security protocols, ensuring data protection and compliance with regulations such as the ESIGN Act and UETA.

Alternatives to pdfFiller for copying electronically signing tax sharing agreements

While pdfFiller offers robust features for electronically signing tax sharing agreements, alternatives like Adobe Sign and DocuSign may suit different user needs. Each platform has unique aspects in terms of pricing, functionality, and integration options, which could affect your choice.

-

Adobe Sign - known for its extensive integrations and user-friendly interface.

-

DocuSign - widely recognized and trusted with a strong focus on compliance.

-

HelloSign - offers a simplified interface for small businesses and startups.

Conclusion

In today's fast-paced digital landscape, the ability to copy electronically signing tax sharing agreements through platforms like pdfFiller is vital for efficiency and security. By mastering this process, you empower yourself to manage tax documentation effectively while ensuring compliance and streamlined workflows.

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms