Examples Of Exempt Commodities

What is Examples of exempt commodities?

Examples of exempt commodities are goods that are not subject to tax or duty when imported or exported. These items are typically considered essential or have specific legal exemptions that exempt them from traditional taxation.

What are the types of Examples of exempt commodities?

There are various types of exempt commodities, including but not limited to:

Medical supplies and equipment

Food and agricultural products

Books and educational materials

Humanitarian aid and relief supplies

How to complete Examples of exempt commodities

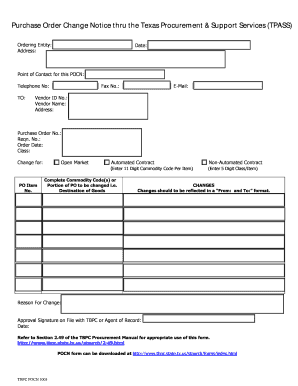

Completing examples of exempt commodities involves following specific guidelines and regulations set forth by the governing authorities. Here are some steps to help you navigate the process:

01

Ensure that the goods qualify as exempt commodities

02

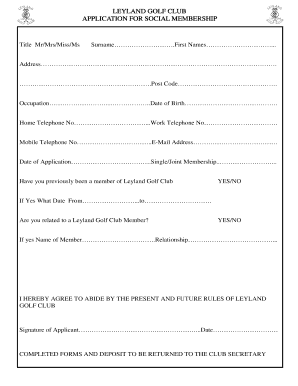

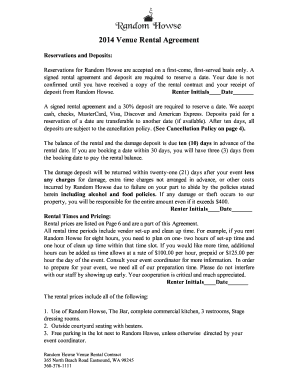

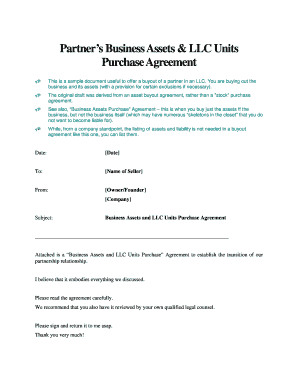

Fill out the necessary documentation accurately

03

Submit the paperwork to the appropriate authorities

04

Keep records of the transaction for future reference

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Examples of exempt commodities

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What commodities are regulated by the Fmcsa?

Animals - see Livestock. Bagged commodities - Placing exempt. their exempt status - Office. Bagging - scrap (worn jute bagging)- Not exempt - Office. Bananas - Not exempt-Law Ruling. Bark - see Forest Products. Barley - see Grains. Bees – Exempt - Law. Beeswax - crude, in cakes and slabs- Beet pulp - see Feeds.

What are non exempt commodities?

Freight that is processed is typically classified as non-exempt because it tends to last longer and may contain preservatives that prevent spoilage. Some examples are: Paper products. Gravel.

What are exempt commodities in trucking?

Exempted commodities, as defined by the FMCSA, are specific types of cargo or materials that are not subject to certain regulations typically imposed on other types of freight.

What does for hire exempt commodities mean?

For-Hire - Exempt Commodities: definition A for-hire motor carrier that transports exempt (unregulated) property owned by others for compensation. The exempt commodities usually include unprocessed or unmanufactured goods, fruits and vegetables, and other items of little or no value.

What are considered exempt commodities?

An exempt commodity is any exchange traded commodity that is not an excluded commodity or an agricultural commodity, such as energy and metal commodities. Transactions in an exempt commodity may only take place between eligible contract participants or commercial entities.

Is livestock an exempt commodity?

49 CFR § 395.1(k) provides exemptions from the HOS rules, during planting and harvesting periods as determined by the State, for the transportation of agricultural commodities (including livestock, bees, horses, fish used for food, and other commodities that meet the definition of “agricultural commodity” under § 395.2