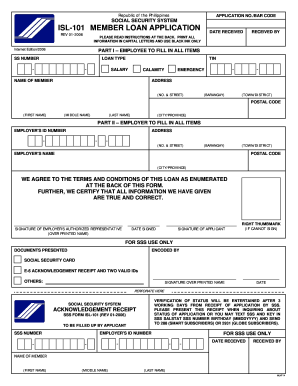

Loan Agreement Sample Philippines

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the legal document for loaning money to a friend?

Loan agreements, promissory notes, and IOUs The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed. They do not usually say when payment is due, nor include any interest provisions.

How do I set up a loan contract between friends?

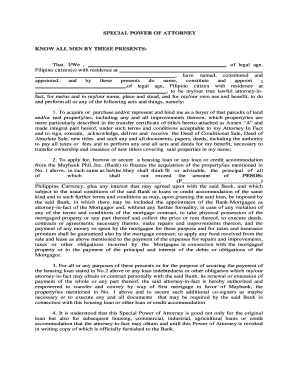

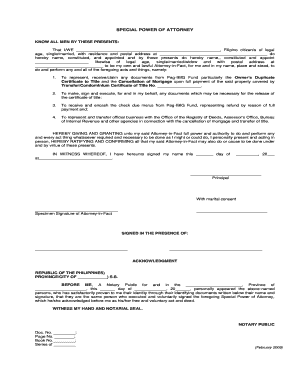

Consider including: Names and addresses of the parties to the agreement. Loan amount (principal). Interest rate. Repayment terms, including dates, and any late fees or penalties. Signature lines.

Can I write my own loan agreement?

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

How do I write a simple personal loan agreement?

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

Does a personal loan agreement need to be notarized?

While without notarization a loan agreement is valid, notarization makes it legally binding and enforceable.

How do I write a personal loan agreement between friends?

Get It in Writing Your name and the borrower's name. The date the loan was granted. The amount of money being lent. Minimum monthly payment. Payment due date. Interest rate, if you're charging interest. Consequences for defaulting on the loan.