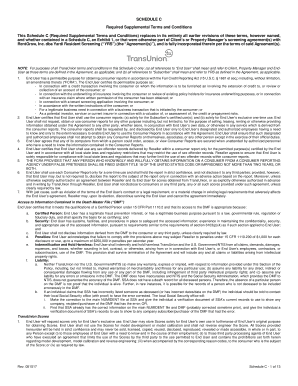

Glba Privacy Notice

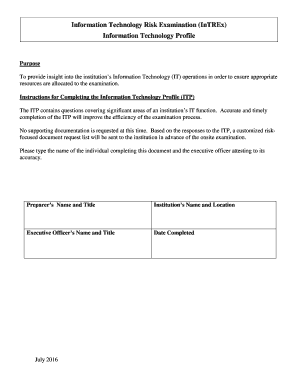

What is Glba privacy notice?

GLBA privacy notice refers to the document that financial institutions, like banks and credit unions, are required to provide to their customers explaining their privacy policies and how they handle customers' personal information.

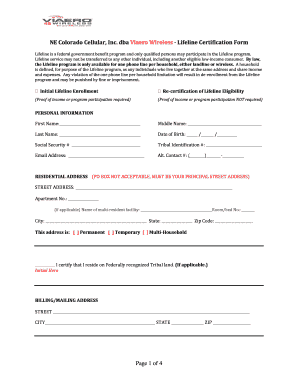

What are the types of Glba privacy notice?

There are two main types of GLBA privacy notices: initial privacy notices and annual privacy notices. Initial privacy notices are provided to customers when they first establish a relationship with a financial institution, while annual privacy notices are sent out at least once a year to all existing customers to remind them of the institution's privacy policies.

How to complete Glba privacy notice

Completing a GLBA privacy notice is a simple process that involves reviewing the information provided by the financial institution and making sure your personal information is correct. To complete a GLBA privacy notice, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.