Bank Reference Letter Meaning

What is Bank reference letter meaning?

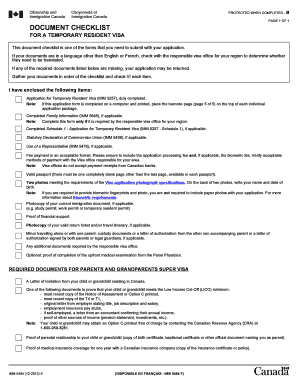

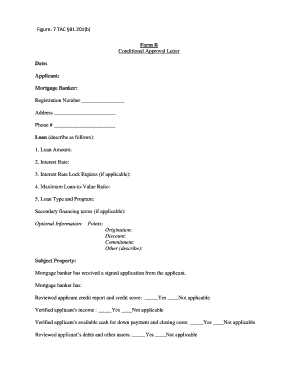

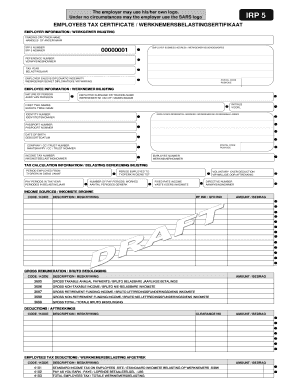

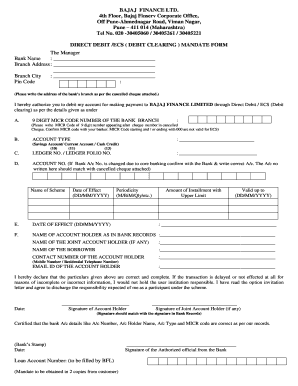

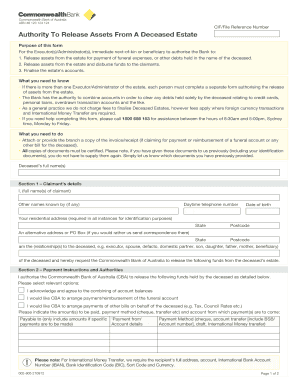

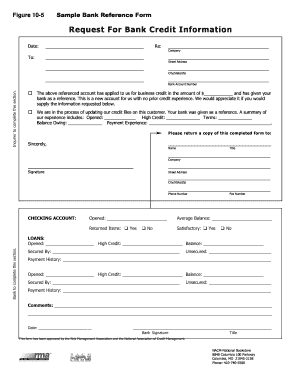

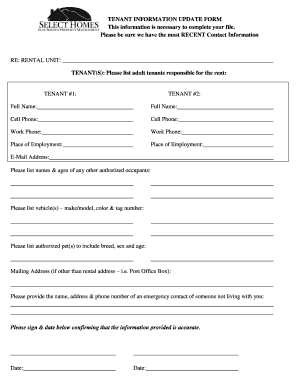

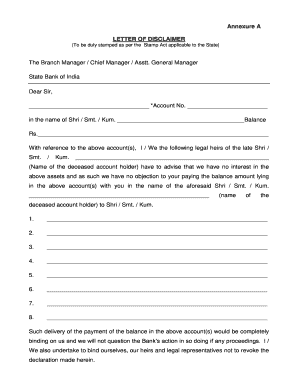

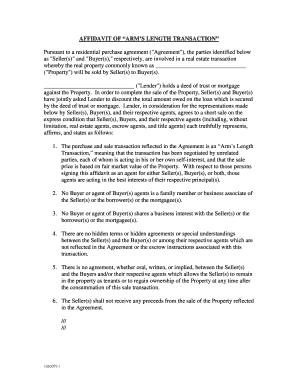

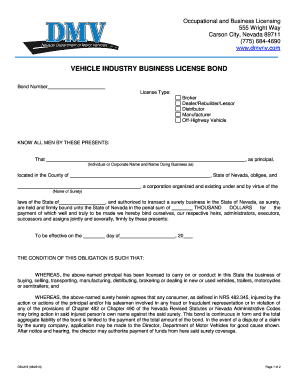

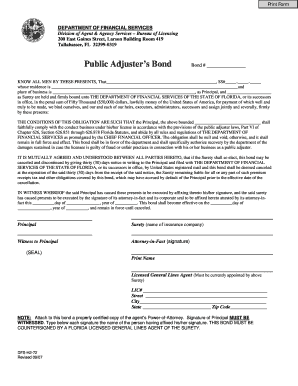

A Bank reference letter is a document provided by a bank on behalf of a customer to confirm details about their account, credit history, or standing with the bank. It serves as a testimony of the customer's financial reliability and can be used for various purposes like applying for a loan, renting a property, or opening a new account.

What are the types of Bank reference letter meaning?

There are two main types of Bank reference letters: general reference letters and specific reference letters. General reference letters provide an overall account summary without disclosing specific details, while specific reference letters detail specific aspects like account balances, transaction history, or credit check results.

How to complete Bank reference letter meaning

To complete a Bank reference letter, follow these simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.