Business Loan Application Form Pdf

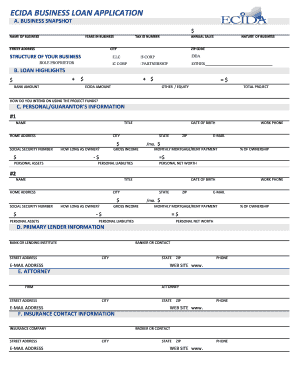

What is Business loan application form pdf?

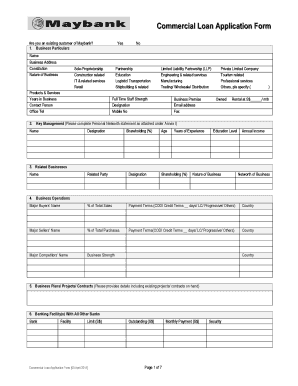

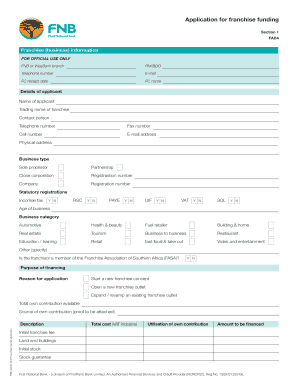

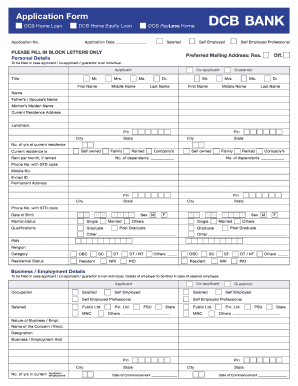

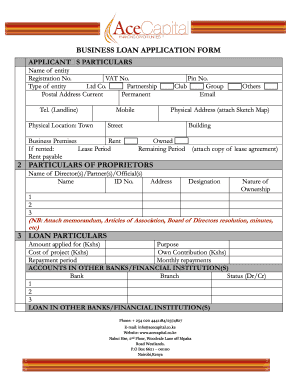

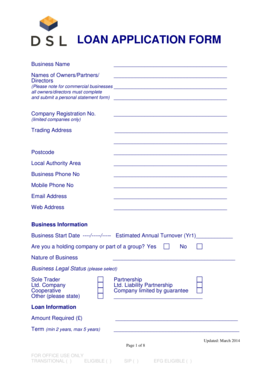

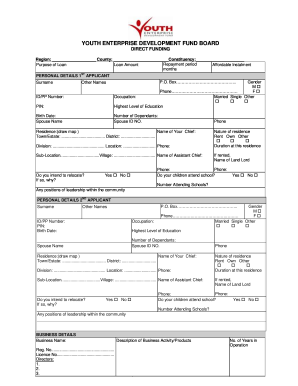

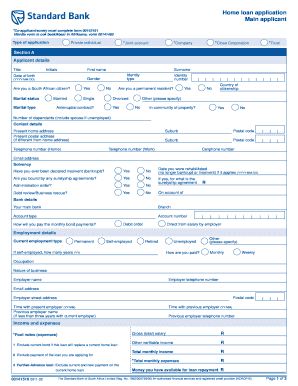

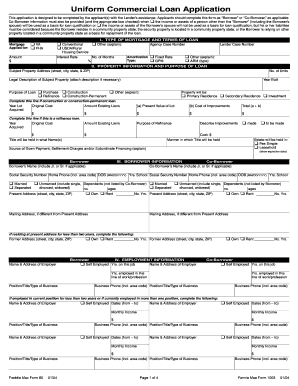

A Business loan application form in PDF format is a standardized document used by financial institutions to collect information from businesses seeking funding. This form is essential for the application process, as it includes details about the company, its financial status, and the purpose of the loan.

What are the types of Business loan application form pdf?

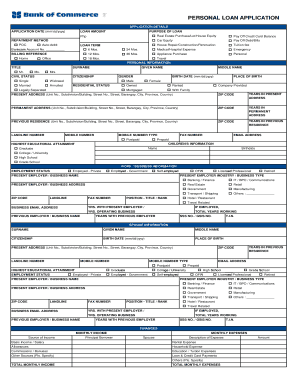

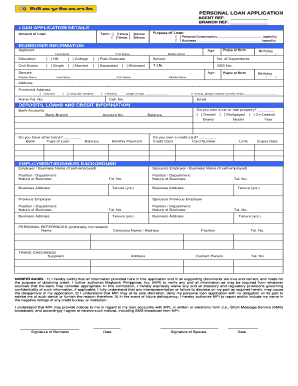

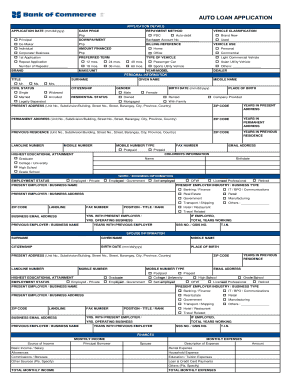

There are several types of Business loan application forms in PDF format, including: 1. Standard loan application form 2. Small business loan application form 3. Equipment financing application form 4. Working capital loan application form Each type caters to different funding needs and requirements.

How to complete Business loan application form pdf

Completing a Business loan application form in PDF format is a simple and straightforward process. Follow these steps to fill out the form accurately: 1. Gather all the necessary documents and information required for the application. 2. Open the PDF form using a reliable editor like pdfFiller. 3. Fill in the required fields with accurate information. 4. Review the completed form for any errors or missing details. 5. Save the filled-out form and submit it to the financial institution for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.