Business Loan Application Format

What is Business loan application format?

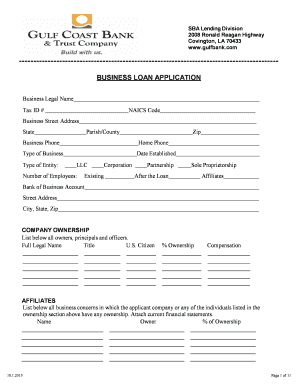

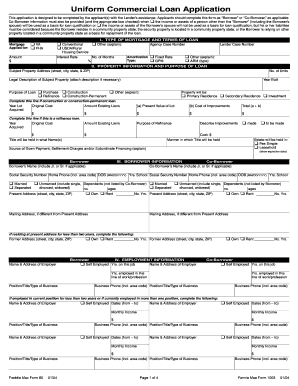

The business loan application format is a structured document used by entrepreneurs and business owners to request financial assistance from lending institutions. It includes detailed information about the business, its financial situation, and the purpose of the loan.

What are the types of Business loan application format?

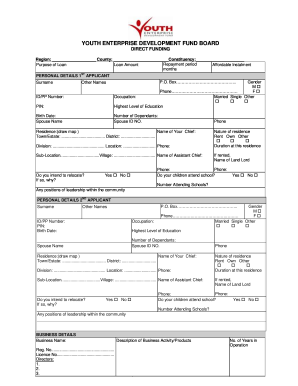

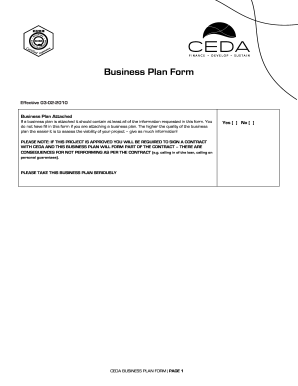

There are several types of business loan application formats, including:

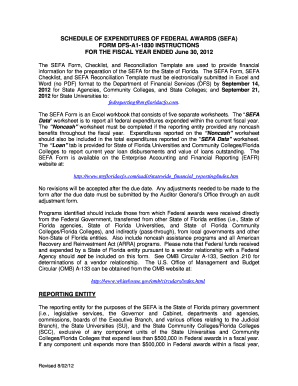

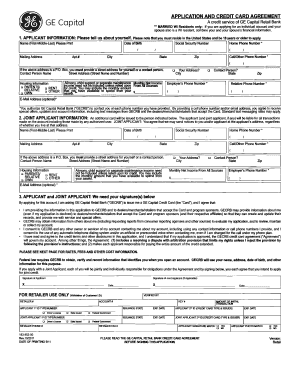

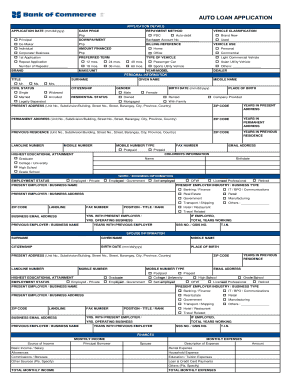

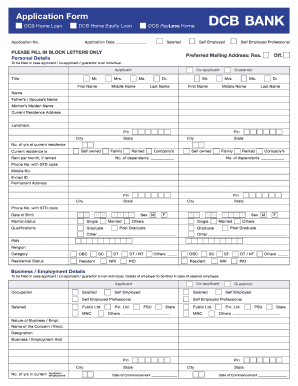

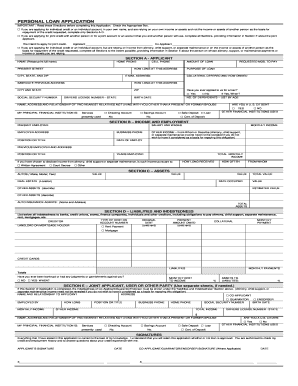

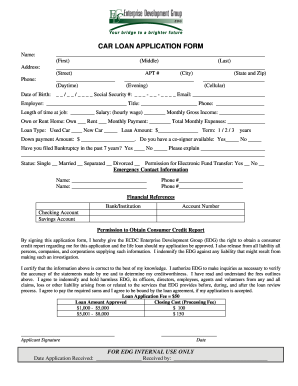

Traditional paper-based application forms

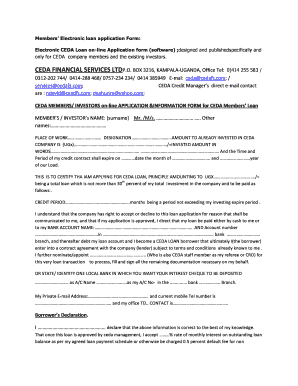

Online application forms

Customized application formats based on lender requirements

How to complete Business loan application format

Completing a business loan application format is a crucial step in securing funding for your business. Here are some tips to help you through the process:

01

Gather all required documentation, including financial statements and business plans

02

Fill out the application form accurately and completely

03

Double-check all information before submitting the application

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Business loan application format

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is usually required for a business loan?

What do banks require for a small-business loan? Banks generally require that you have good to excellent credit (score of 690 or higher), strong finances and at least two years in business to qualify for a loan. They'll likely require collateral and a personal guarantee as well.

What are the 6 steps to getting a business loan?

How to get a business loan in 6 steps Choose a type of loan. Decide how much you can afford to borrow. Check your eligibility. Gather required documents. Apply for a loan. Frequently asked questions.

How to write a business loan application?

However, they should be written professionally and in great detail. Heading And Greeting. Summary of Your Business Loan Request Letter. Basic Information About Your Business. Description Of The Purpose Of The Loan. Show Your Ability to Repay the Loan. Concluding Elements.

How do I draft a loan application?

The loan application letter format is generally six paragraphs long, with each major topic discussed in a separate paragraph. The content includes the loan amount requested, a description of your business, the purpose of the loan, target market and competition, and the amount you have invested in your business.

How to write a letter to a bank requesting a loan to start a business?

How to Write a Bank Loan Request Letter Start your bank loan request by briefly explaining what your business does. Include essential business information. Specify how much money you would like to borrow and what type of loan you are seeking. Explain how you will use the loan proceeds to attain specific business goals.

What is the process of getting a business loan?

How to get a business loan in 6 steps Choose a type of loan. Decide how much you can afford to borrow. Check your eligibility. Gather required documents. Apply for a loan. Frequently asked questions.