Debt Collection Laws

What is Debt collection laws?

Debt collection laws are a set of regulations that govern how creditors can legally collect debts from individuals or businesses. These laws ensure that debt collection practices are fair and ethical, protecting consumers from harassment and abuse by debt collectors.

What are the types of Debt collection laws?

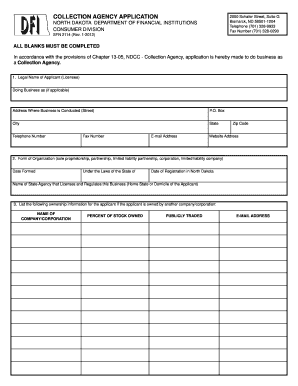

There are several types of debt collection laws that provide guidelines for creditors and debt collectors on how to pursue debts. Some common types include:

Fair Debt Collection Practices Act (FDCPA)

Statute of Limitations on Debt

Debt settlement laws

Bankruptcy laws

State-specific debt collection laws

How to complete Debt collection laws

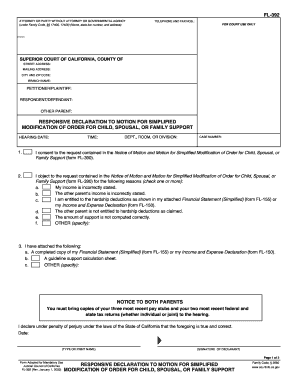

To ensure compliance with debt collection laws, follow these steps:

01

Understand the relevant laws and regulations in your jurisdiction

02

Maintain accurate records of all communication with debtors

03

Provide clear and accurate information to debtors about their rights and options

04

Seek legal advice if facing challenges in debt collection

05

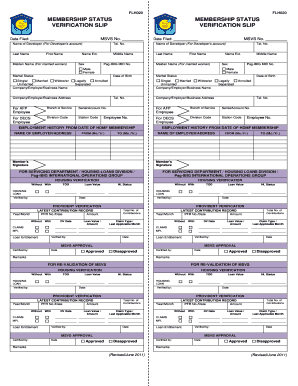

Utilize tools like pdfFiller to streamline document creation and management

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to get their documents done efficiently and effectively.

Video Tutorial How to Fill Out Debt collection laws

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are 3 things that a debt collection agency Cannot do?

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

How long before a debt becomes uncollectible?

Statute of limitations on debt for all states StateWrittenOralCalifornia4 years2Colorado6 years6Connecticut6 years3Delaware3 years346 more rows • 5 days ago

What are three things debt collectors are prohibited from doing?

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

What should you not do with a debt collector?

Don't give a collector any personal financial information, make a "good faith" payment, make promises to pay, or admit the debt is valid.

What is the 7 and 7 rule in debt collection?

This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period. Also, they must not contact the individual within seven days after engaging in a phone conversation about a particular debt.

What is the new debt collection rule?

The Debt Collection Rule limits the contact a debt collector can make with consumers. Examples of such limitations include: No calls before 8 a.m. or after 9 p.m. in the consumer's time zone. No subsequent contact with the consumer for seven days following a conversation with them. No more than seven phone calls per