Debt Validation Letter

What is a Debt validation letter?

A Debt validation letter is a written request sent to a creditor or debt collector asking them to provide proof that a debt exists and that they have the right to collect it from you. This letter is a crucial tool for consumers to ensure that they are not being wrongly pursued for a debt they do not owe.

What are the types of Debt validation letter?

There are two main types of Debt validation letters:

Initial Debt validation letter: This is the first letter you send to a creditor or debt collector requesting validation of the debt.

Follow-up Debt validation letter: If you do not receive a satisfactory response to your initial request, you can send a follow-up letter asking for further documentation or clarification.

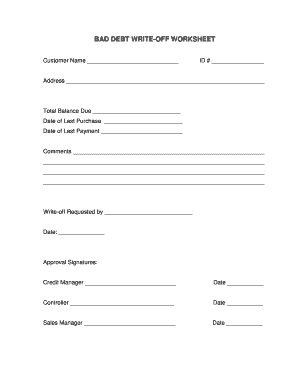

How to complete Debt validation letter

To complete a Debt validation letter, follow these steps:

01

Start by addressing the letter to the creditor or debt collector.

02

Include your name, address, and account information to help them locate your account.

03

Clearly state that you are requesting validation of the debt and ask for specific information such as the original creditor, amount owed, and proof of ownership.

04

Send the letter via certified mail to have proof of delivery and keep a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out Debt validation letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

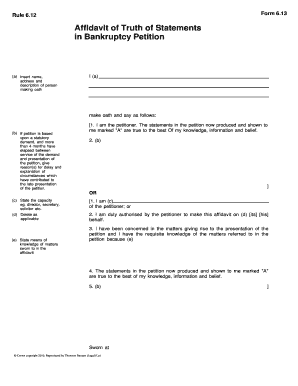

Do I need to send a debt validation letter?

Debt validation letters are mandatory under the FDCPA, which states that “within five days after the initial communication with a consumer in connection with the collection of any debt, a debt collector … shall send the consumer a written notice including” several items: The amount of debt.

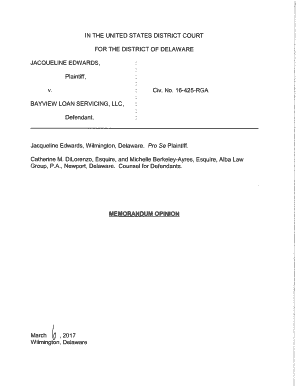

Do debt validation letters really work?

And sometimes someone is trying to scam you. That's why it's important to verify your debts with the proper documentation, such as a debt validation letter. Doing so can protect you from scammers, prevent debt collectors from pestering you and keep you from paying money you don't owe.

What happens if I don't receive a debt validation letter?

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted.

When should a validation of debt notice be sent?

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one. Why? Because it helps you determine if the debt is actually yours and if there's anything fishy going on behind the scenes.

Should you send a debt validation letter?

Nearly every time someone is contacted by a debt collector about a debt, they should send the collector a Debt Validation Letter. The letter forces the collector to treat you with respect and to get serious about the matter.

What is a debt validation letter?

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and to who, as well as when you need to pay the debt. If you're still uncertain about the debt you're being asked to pay, you can request a debt verification letter to get more information.