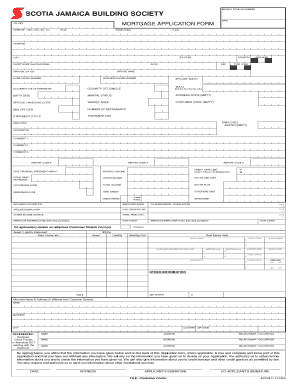

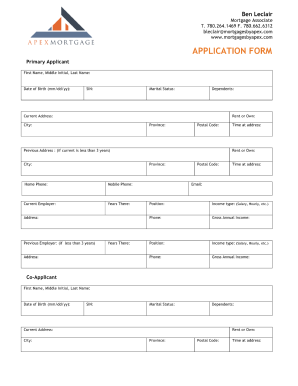

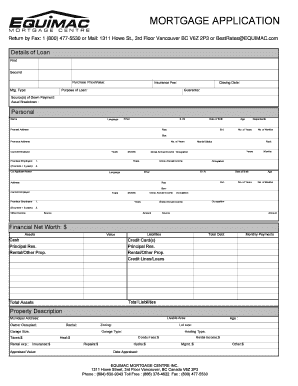

Mortgage Application Form Pdf

What is Mortgage application form pdf?

A Mortgage application form pdf is a digital document that allows individuals to apply for a mortgage loan online. It provides a convenient way for users to fill out necessary information and submit their application electronically.

What are the types of Mortgage application form pdf?

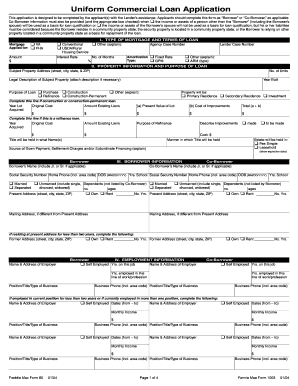

There are several types of Mortgage application form pdf, including:

Standard Mortgage application form

FHA Mortgage application form

VA Mortgage application form

Adjustable-rate Mortgage application form

How to complete Mortgage application form pdf

Completing a Mortgage application form pdf is simple and easy. Here are some tips to help you fill out the form accurately:

01

Open the PDF file using a program like pdfFiller

02

Fill in your personal information, including name, address, and contact details

03

Provide details about your employment history and income

04

Enter information about the property you wish to purchase or refinance

05

Review the completed form for accuracy before submitting it

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out Mortgage application form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 5 steps of the mortgage process?

Once you know the steps to obtain a mortgage loan, it will make the process of buying a home much easier. Step 1: Apply and Pre-qualify. Step 2: Loan Processing. Step 3: Home Appraisal. Step 4: Final Approval. Step 5: Closing.

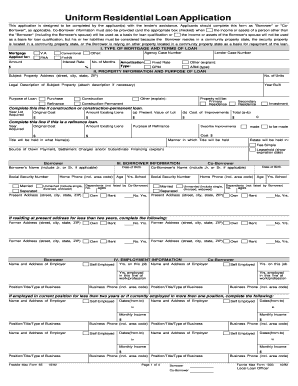

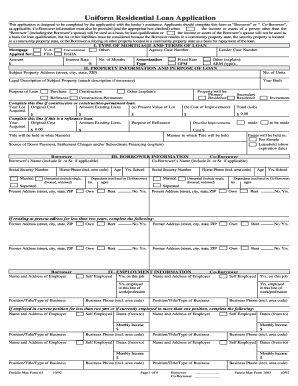

What is a 1003 form on a mortgage?

The 1003 mortgage application, also known as the Uniform Residential Loan Application, is the standard form nearly all mortgage lenders in the United States use. Borrowers complete this basic form—or its equivalent, Form 65—when they apply for a mortgage loan.

What is the mortgage form 1009?

For the borrower's application, an FHA-insured reverse mortgage (Home Equity Conversion Mortgage or HECM), the lender must use the Residential Loan Application for Reverse Mortgages (Fannie Mae Form 1009).

What are the 4 elements of mortgage?

Your monthly mortgage payment typically has four parts: loan principal, loan interest, taxes, and insurance. If you've never owned a home before, you may be surprised that a mortgage payment has that many components. By including these costs in one monthly payment, your lender helps make things easier for you.

What is the alternative name for the 1003 loan application?

Fannie Mae and Freddie Mac (the GSEs) redesigned the Uniform Residential Loan Application (URLA) (Fannie Mae Form 1003) and created new automated underwriting system (AUS) specifications (Fannie Mae Desktop Underwriter® [DU®] Spec) to help lenders better capture relevant loan application information and support the

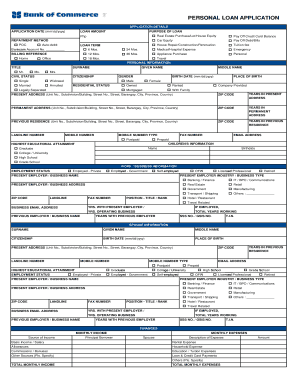

What are the six pieces of Trid application?

Submitting these 6 pieces of information: Name. Income. Social Security Number. Property Address. Estimated Value of Property. Mortgage Loan Amount sought.