Money Services Business Act

What is Money services business act?

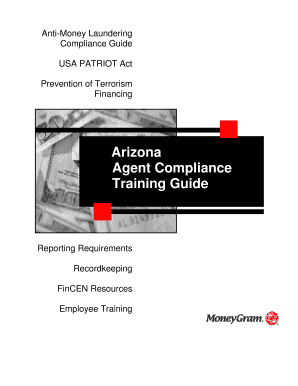

The Money Services Business Act is a piece of legislation that regulates businesses providing services related to money transfer, currency exchange, or payment processing. Its main purpose is to prevent financial crimes such as money laundering and terrorist financing.

What are the types of Money services business act?

There are three main types of businesses covered under the Money Services Business Act:

Money transmitters

Currency exchanges

Check cashers

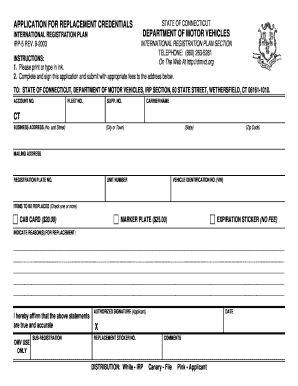

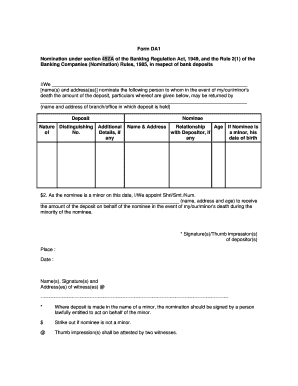

How to complete Money services business act

Completing the Money Services Business Act requires following these steps:

01

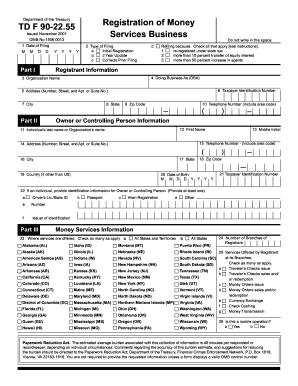

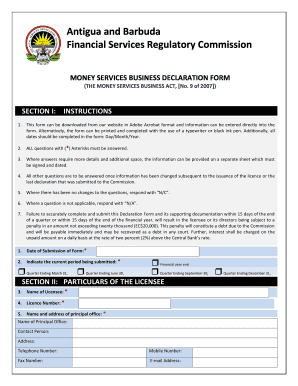

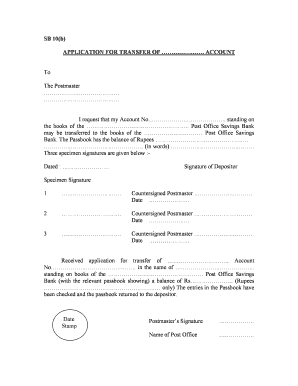

Register your business with the appropriate regulatory agency

02

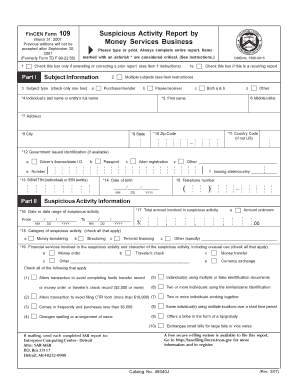

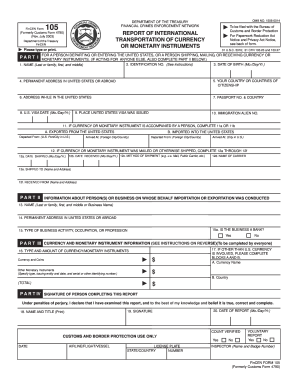

Establish and maintain effective anti-money laundering procedures

03

Submit regular reports and documentation to the regulatory authority

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Money services business act

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is considered a money services business?

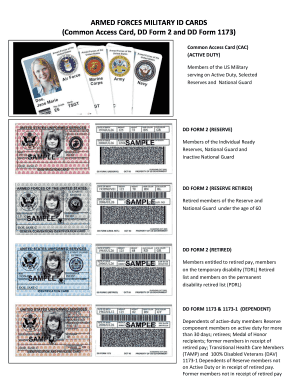

The term "money services business" includes any person doing business, whether or not on a regular basis or as an organized business concern, in one or more of the following capacities: (1) Currency dealer or exchanger. (2) Check casher. (3) Issuer of traveler's checks, money orders or stored value.

What are the risks of MSB?

Lack of Deposit Protection: Unlike traditional banks, MSBs may not offer deposit insurance or similar protections for customer funds. This means that if an MSB were to face financial difficulties or go bankrupt, there might be a risk of losing deposited funds.

What is the final rule for MSB?

The Final Rule requires each foreign-located MSB to appoint a person residing in the United States as an agent for service of legal process with respect to compliance with the BSA and its implementing regulations. The Final Rule became effective on September 19, 2011.

What is considered a money service business?

A money services business (MSB) is a legal term used by financial regulators to describe businesses that transmit or convert money. The definition was created to encompass more than just banks which normally provide these services to include non-bank financial institutions.

What are the record keeping requirements for money service business?

A money services business shall maintain a copy of any SAR filed and the original or business record equivalent of any supporting documentation for a period of five years from the date of filing the SAR.

What is the Money Service Business Bank Secrecy Act?

1829b, 12 U.S.C. 1951-1959, and 31 U.S.C. 5311-5330. The Bank Secrecy Act authorizes the Secretary of the Treasury, inter alia, to issue regulations requiring financial institutions to keep records and file reports that are determined to have a high degree of usefulness in criminal, tax, and regulatory matters.