Loan Application Form Online

What is Loan application form online?

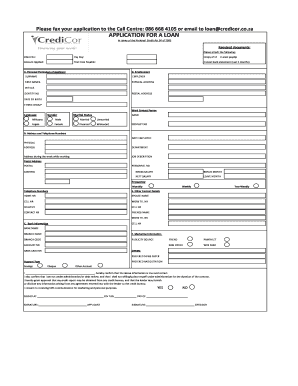

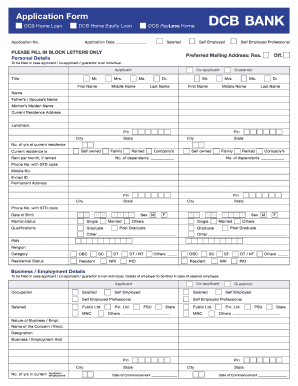

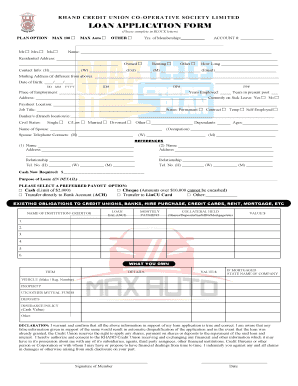

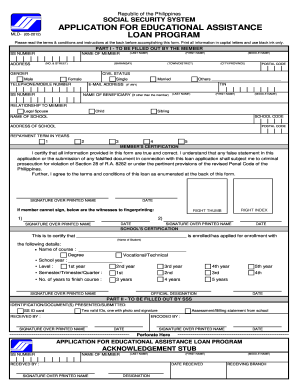

A loan application form online is a digital document that allows individuals to apply for a loan through a website or online platform. This convenient method eliminates the need for paper forms and allows users to complete the application process quickly and efficiently.

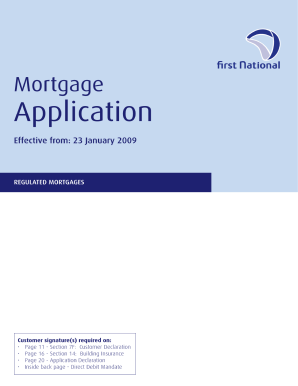

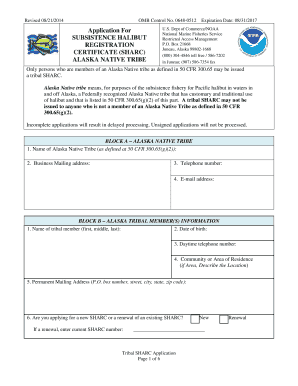

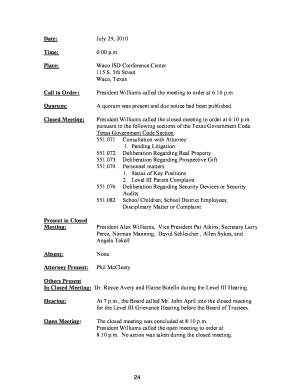

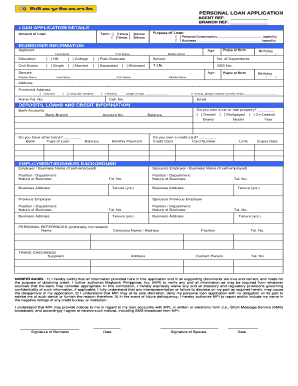

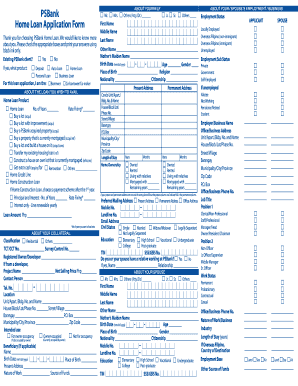

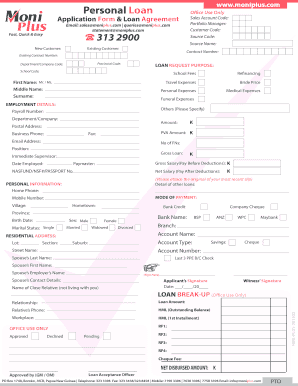

What are the types of Loan application form online?

There are several types of loan application forms that can be found online, including: Personal loan application form, Mortgage loan application form, Auto loan application form, Business loan application form.

How to complete Loan application form online

Completing a loan application form online is easy and convenient. Follow these steps to successfully submit your application: 1. Visit the lender's website and navigate to the loan application page. 2. Fill in your personal information, including your name, contact details, and employment information. 3. Provide details about the loan amount you are requesting and the purpose of the loan. 4. Upload any required documentation, such as pay stubs or tax returns. 5. Review the information you have provided and submit the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.